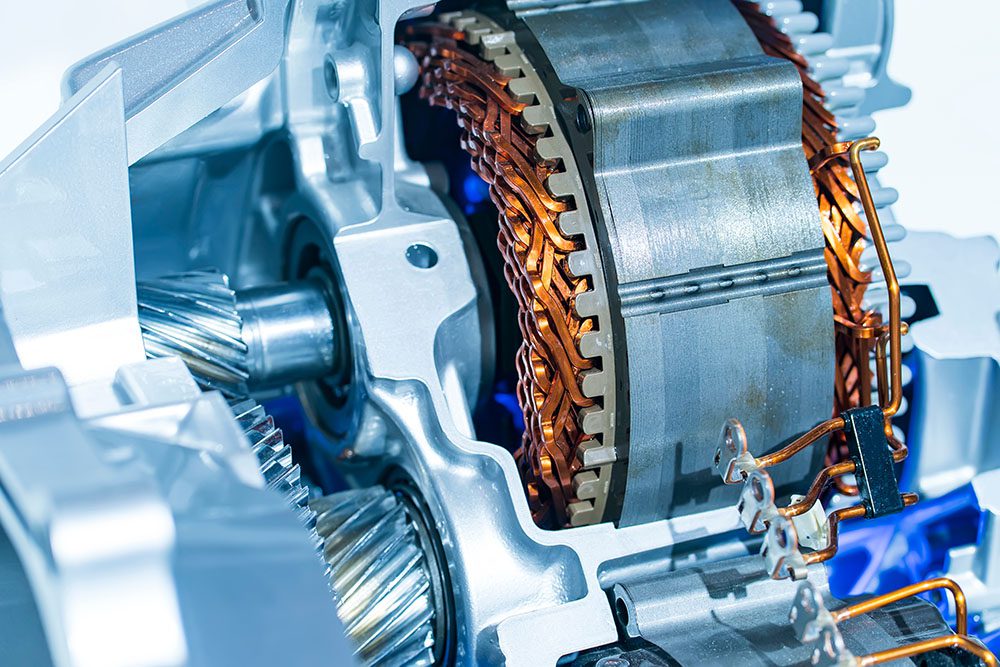

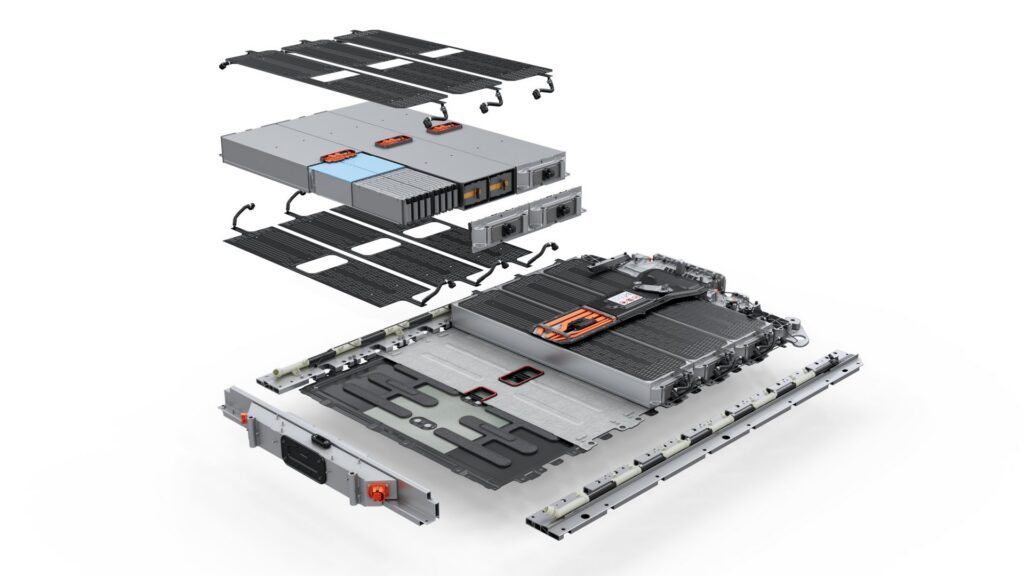

Proterra is best known as an electric transit bus OEM, but it has branched out into providing electric powertrain solutions to other vehicle manufacturers and turnkey charging and energy management solutions to fleets.

The company has long been considered a likely candidate for a public share offering, and now it has announced that it will go public through a transaction with a special purpose acquisition company (SPAC) called ArcLight Clean Transition (Nasdaq: ACTC). Upon closing, Proterra’s common stock is expected to trade on the Nasdaq under the ticker symbol PTRA.

The transaction, which is expected to close in the first half of 2021, represents an enterprise value of $1.6 billion for Proterra. Jack Allen, Proterra’s Chairman and CEO, will continue to lead the company, and Jake Erhard, CEO of ArcLight, will join Proterra’s board.

Proterra is expected to report around $193 million in revenue for 2020, and says it has $750 million worth of orders on its books. Upon completion of the transaction, the company expects to have up to $825 million in cash to fund various growth initiatives.

The announcement caught many in the stock-market chatterverse by surprise. The word on the street was that Proterra would go public through a deal with a SPAC called Qell. Former Proterra CEO Ryan Popple is a member of Qell’s board, and Qell’s CEO, Barry Engle, is a former President of GM North America who has expressed a strong interest in e-mobility.

“After delivering our first electric transit bus a decade ago, Proterra has transformed into a diversified provider of electric vehicle technology solutions to help commercial vehicle manufacturers electrify their fleets,” said Proterra CEO Jack Allen. “This transaction enables Proterra to take the next step towards our mission of advancing EV technology to deliver the world’s best-performing commercial vehicles. In addition, it introduces a partner in ArcLight that has a shared focus on sustainability and renewable energy.”

Source: Proterra