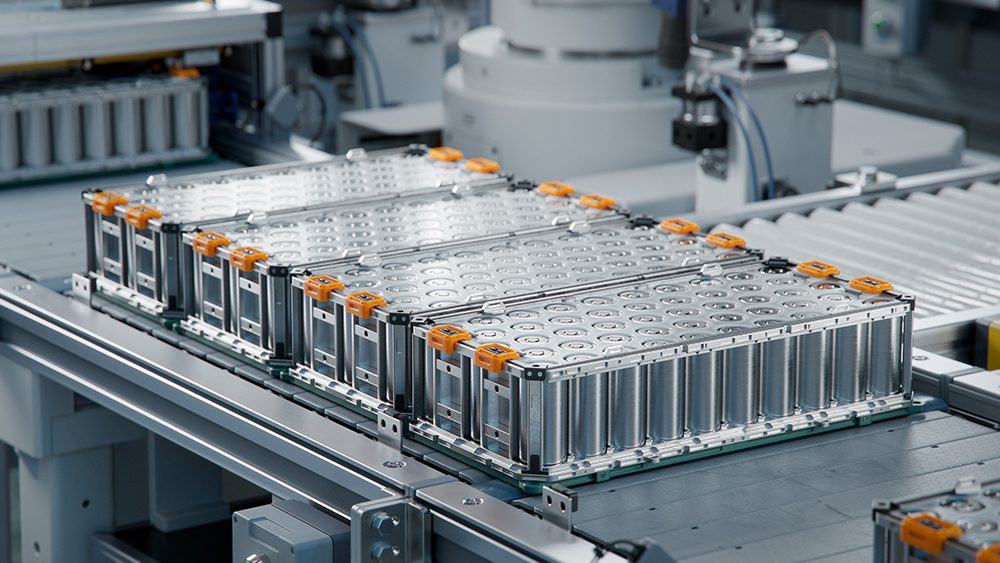

The state of California has granted Tesla a $34.7-million tax break on a batch of new manufacturing equipment valued at around $415 million. California is one of the few states that taxes the purchase of manufacturing equipment, but it sometimes offers exemptions to clean-tech companies. Tesla received a similar deal in 2010 when it bought and retooled the former NUMMI plant in Fremont.

The new gear will allow Tesla to expand annual production by 35,000 vehicles, according to SFGate. The company currently plans to build 21,500 Model S sedans this year, but it’s also producing powertrains for partners Daimler and Toyota, and will start cranking out the Model X crossover in 2014. And of course, Tesla intends to vastly increase its manufacturing capacity when the mid-market Model E becomes a reality.

The state estimates that the new equipment could help Tesla create 112 new permanent jobs, more than making up for the loss of tax revenue. “I’m pleased we could take this action to encourage Tesla to expand its electric vehicle production in California, which will create green jobs and improve our air quality,” said State Treasurer Bill Lockyer.

Source: Green Car Reports, SFGate