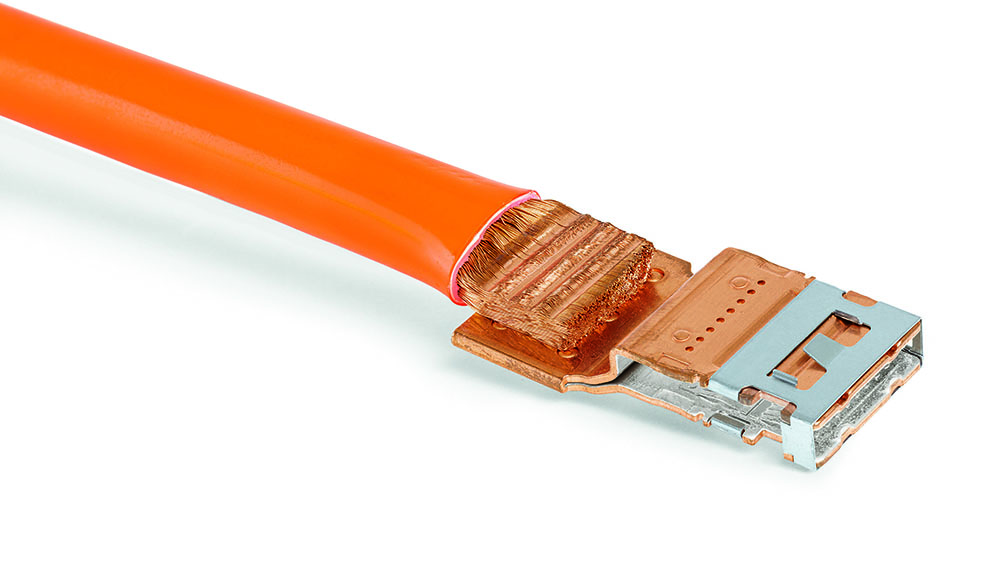

Cincinnati-based AMP specializes in converting legacy vehicles to electric power.

Can’t find a production EV that meets your needs? What if you could have a gas-guzzling SUV converted to a zero-emission modern vehicle, and still claim the tax benefits? Well, now you can. AMP Electric Vehicles announced today that the IRS has certified the eligibility of their vehicles for the $7,500 federal tax credit. Several states offer additional tax goodies.

Cincinnati-based AMP specializes in converting legacy vehicles to electric power. Among the company’s current offerings are electric versions of the Jeep Grand Cherokee, Chevrolet Equinox, Saturn Sky, and Pontiac Solstice.

“The timing of AMP's qualifying for the Federal Plug-in Electric Drive Motor Vehicle Credit of $7,500, which applies to retail and fleet buyers, couldn't be better,” said Jim Taylor, AMP CEO. “Given the recent increase in gas prices and the low operating cost of an EV, more buyers are turning their attention to EV alternatives.”

“After the tax credit, an AMP EV buyer can drive an all-electric SUV for as little as $49,900, a very competitive price for an EV,” said AMP dealer Dana Hackney. “When our buyers compare AMP’s SUVs to other smaller EV offerings they will be very impressed.”

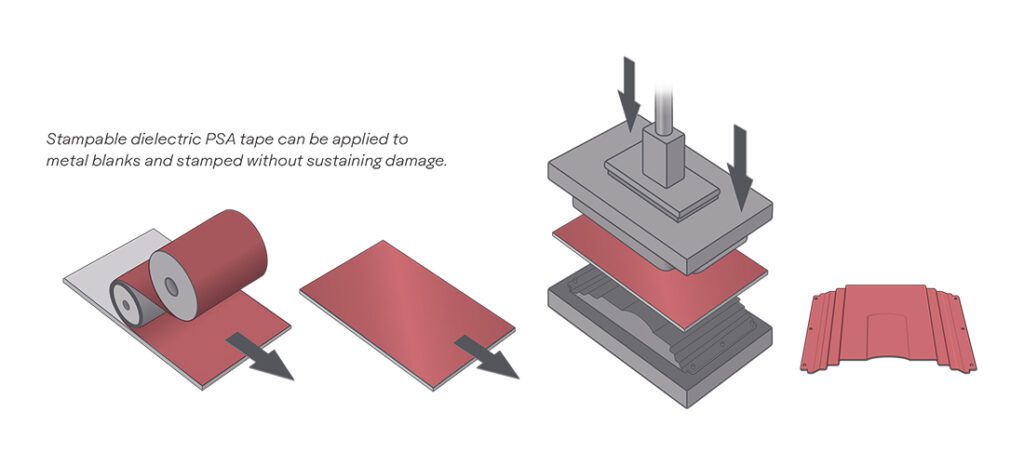

Image: Amp Electric Vehicles