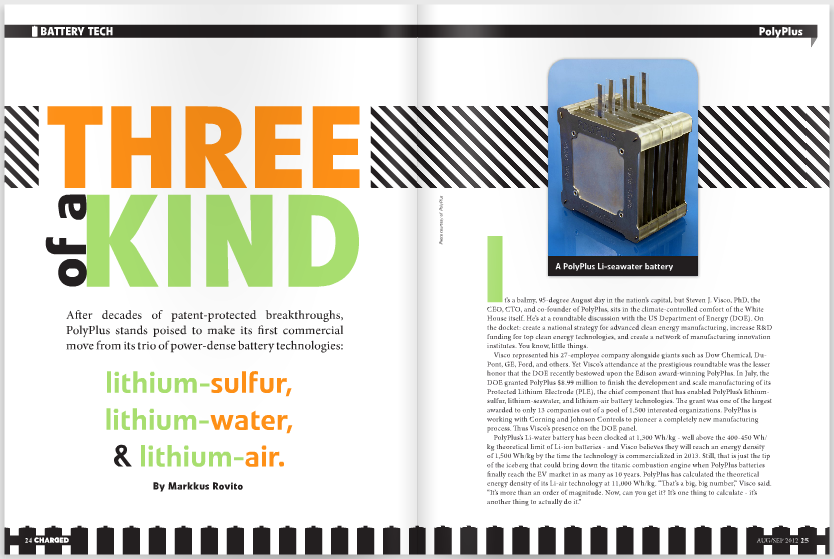

After decades of patent-protected breakthroughs, PolyPlus stands poised to make its first commercial move from its trio of power-dense battery technologies: lithium-sulfur, lithium-water, and lithium-air.

It’s a balmy, 95-degree August day in the nation’s capital, but Steven J. Visco, PhD, the CEO, CTO, and co-founder of PolyPlus, sits in the climate-controlled comfort of the White House itself. He’s at a roundtable discussion with the US Department of Energy (DOE). On the docket: create a national strategy for advanced clean energy manufacturing, increase R&D funding for top clean energy technologies, and create a network of manufacturing innovation institutes. You know, little things.

Visco represented his 27-employee company alongside giants such as Dow Chemical, DuPont, GE, Ford, and others. Yet Visco’s attendance at the prestigious roundtable was the lesser honor that the DOE recently bestowed upon the Edison award-winning PolyPlus. In July, the DOE granted PolyPlus $8.99 million to finish the development and scale manufacturing of its Protected Lithium Electrode (PLE), the chief component that has enabled PolyPlus’s lithium-sulfur, lithium-seawater, and lithium-air battery technologies. The grant was one of the largest awarded to only 13 companies out of a pool of 1,500 interested organizations. PolyPlus is working with Corning and Johnson Controls to pioneer a completely new manufacturing process. Thus Visco’s presence on the DOE panel.

Visco represented his 27-employee company alongside giants such as Dow Chemical, DuPont, GE, Ford, and others. Yet Visco’s attendance at the prestigious roundtable was the lesser honor that the DOE recently bestowed upon the Edison award-winning PolyPlus. In July, the DOE granted PolyPlus $8.99 million to finish the development and scale manufacturing of its Protected Lithium Electrode (PLE), the chief component that has enabled PolyPlus’s lithium-sulfur, lithium-seawater, and lithium-air battery technologies. The grant was one of the largest awarded to only 13 companies out of a pool of 1,500 interested organizations. PolyPlus is working with Corning and Johnson Controls to pioneer a completely new manufacturing process. Thus Visco’s presence on the DOE panel.

PolyPlus’s Li-water battery has been clocked at 1,300 Wh/kg – well above the 400-450 Wh/kg theoretical limit of Li-ion batteries – and Visco believes they will reach an energy density of 1,500 Wh/kg by the time the technology is commercialized in 2013. Still, that is just the tip of the iceberg that could bring down the titanic combustion engine when PolyPlus batteries finally reach the EV market in as many as 10 years. PolyPlus has calculated the theoretical energy density of its Li-air technology at 11,000 Wh/kg. “That’s a big, big number,” Visco said. “It’s more than an order of magnitude. Now, can you get it? It’s one thing to calculate – it’s another thing to actually do it.”

ALL HAIL THE PLE

The slow march toward the most potent battery on Earth quietly began more than 20 years ago in Berkeley, California. Spun off from and funded by Lawrence Berkeley National Laboratory (the same lab associated with the CalCharge battery consortium Charged reported on in the June/July 2012 issue), PolyPlus incorporated in 1990 on the strength of innovations in environmentally friendly lithium-organosulfur batteries.

At the time, the gold standards in rechargeable batteries were nickel-cadmium and lead-acid. PolyPlus was sure that its Li-sulfur chemistry would beat the brakes off them both. Then in 1991, Sony dropped the lithium-ion bomb.

“We had a chemistry in hand that was certainly exciting, but the bar had just ratcheted up quite a bit with Sony’s introduction,” Visco said. “At that point, we knew we had to get to higher energy densities. Lithium-ion was clearly going to be improving. If you’re going to launch something new competing with an incumbent technology, and you’re, say, five years out, you’ve got to make sure that you’re sufficiently that much higher, so that when you commercialize, you have a big advantage.”

Visco believed that PolyPlus had the most advanced Li-sulfur technology in the world, but they had problems with self-discharge of the cells. “We concluded that the only way to solve the problem of lithium-sulfur was to introduce a solid electrolyte membrane between the anode and the cathode that would shut down all these processes that were creating problems,” Visco said.

PolyPlus’s search for that material lead them to what they believed was the only company in the world that could help them, a Japanese outfit called Ohara. It just so happened that Ohara’s US rep had some of the membranes sitting on his desk, but he thought they’d be no good since they’d been sitting out for more than two years. “Those are the pieces I want,” Visco said. “If you have something on your desk for two years, that indicates that they’re stable. Send them up to me. I’ll test them.”

All the tests PolyPlus ran proved that the Ohara material’s conductivity measured exactly what they had claimed. The next step was to put it up against lithium. “If you can’t put lithium up against it, then its an interesting material but not practical,” Visco said. “But we had developed a special practice internal to PolyPlus, called the interlayer process. We can take something that’s not stable to lithium, put an interlayer on it that is conductive to lithium and then put the lithium down. We did that test, and it worked beautifully. We got stable performance.”

Bolstered by that outcome, PolyPlus decided to experiment further and see what happened when it put water up against the membrane. “That’s really crazy,” Visco said. “You just don’t put lithium in the water. They don’t mix. I figured we might get an interesting paper out of it. We might get a 10-minute type of transient and see something interesting, but that would be the end of it.”

To Visco’s great surprise, he would later receive an exuberant 3 am call from his director of technology explaining that they had just measured the thermodynamic potential of lithium and water for the first time, and that they were moving lithium from the lithium electrode into the water, and then replating metallic lithium from water. Visco asked him, “you know that’s a pretty strong statement, right?”

But sure enough, PolyPlus was onto something, and the company went largely silent as it began writing patents related to its discovery. “We had a material that would definitely solve the biggest problems with lithium-sulfur technology, which are the self-discharge and corrosion,” Visco said. “But we also realized for the first time that you could build a lithium-water battery, and you can build a lithium-air battery, which is kind of the ultimate. If you look at the periodic table of the elements, you want to go to the far corners. You want to go to the lightest negative electrode, which is lithium, and then for the cathode, oxygen is light because it’s free. You don’t have to carry it.”

PolyPlus essentially spent years developing intellectual property that will eventually bring its many technologies to market. To date it holds more than 70 US and international patents, and when adding pending patent applications, Visco says that number approaches almost 150. But the core of the company’s IP is the solid electrolyte membranes that allow for stable Li-sulfur, Li-water, and Li-air batteries. It’s called the Protected Lithium Electrode, or PLE. It is highly conductive to lithium ions, but impervious to liquids and gases, so that the lithium core is electrochemically active but chemically isolated from the external electrolyte.

Now flush with DOE cash, PolyPlus and its partners will manufacture a pilot line this year that will produce the first commercial PLE-enabled batteries: non-rechargeable Li-seawater batteries.

“We need to demonstrate to potential customers that this is a manufacturable technology, that it does what we say it does, that it’s robust, and that it survives in the application environment,” Visco said. “So that’s why we start with what I guess you’d call the low hanging fruit: something where we have a huge advantage. We’ll get experience in the market, manufacturing experience, and credibility in delivering a pretty remarkable product. Then we’ll move toward the rechargeable chemistries, which are going to be more complex. You don’t solve every manufacturing problem from day one. You do it sequentially.”

WHAT CAN BRINE DO FOR YOU?

There are several reasons why Visco feels confident that PolyPlus will have a huge competitive advantage with its non-rechargeable Li-seawater batteries that will go to market in 2013, namely energy density and environmental friendliness.

Although it will be a while before PolyPlus technology hits the electric automobile market, the company will target the EVs of the sea – underwater robots, drones, and other unmanned underwater vehicles (UUVs) – with its Li-water cells. Currently much of those devices run on sulfuryl-chloride chemistry, which Visco criticizes. “Those batteries are typically around 400-500 Wh/kg on the bench top on land, but they don’t tolerate pressure,” Visco said. “They’re put in a glass bubble to be protected from pressure, and they’re pretty dense. If you drop them in water, they sink. An underwater robot has to be neutrally buoyant, so you have to add flotation, because the battery’s weight is too dense.”

As a result, Visco says that the pressure bubble and flotation needed for underwater sulfuryl-chloride batteries de-rate them to an in-use energy density of about 150 Wh/kg. “Our technology is pressure-tolerant – it doesn’t need any kind of protective bubble,” Visco said. “And it’s neutrally buoyant, because lithium’s density is half of water. The lithium-seawater battery actually uses oxygen just like fish do – like artificial gills. It uses the oxygen that’s in seawater, and then the seawater is the electrolyte. By the time you add electrodes, you’re at about density 1. So if our battery is 1300 Wh/kg, it’s still 1300 Wh/kg in use. And we’ll certainly get to 1500 Wh/kg for the commercial version. That’s huge. People get excited when they have a 30 percent performance improvement. We’re saying 10X in some applications.”

As a result, Visco says that the pressure bubble and flotation needed for underwater sulfuryl-chloride batteries de-rate them to an in-use energy density of about 150 Wh/kg. “Our technology is pressure-tolerant – it doesn’t need any kind of protective bubble,” Visco said. “And it’s neutrally buoyant, because lithium’s density is half of water. The lithium-seawater battery actually uses oxygen just like fish do – like artificial gills. It uses the oxygen that’s in seawater, and then the seawater is the electrolyte. By the time you add electrodes, you’re at about density 1. So if our battery is 1300 Wh/kg, it’s still 1300 Wh/kg in use. And we’ll certainly get to 1500 Wh/kg for the commercial version. That’s huge. People get excited when they have a 30 percent performance improvement. We’re saying 10X in some applications.”

That kind of energy density may even lower the red flags that are sure to fly simply from the fact that the batteries are non-rechargeable. Because UUVs have no convenient local power source from which to recharge (as we have for our smartphones, for example), fossil fuel-burning ships have to stay at sea waiting for them to return and recharge. Visco feels confident that PolyPlus’ non-rechargeable Li-water batteries will save its customers money in the end.

“The cost for small surface ships is a minimum of $20,000 per day,” Visco said, “to say nothing of the waste of fuel and production of CO2 while it’s sitting there. In contrast to this, if one outfits a UUV with a high-performance Li-water battery, the UUV can head off for days (or months, depending on the power requirements), and return to shore or be picked up by a surface ship later.”

When it comes to toxicity, PolyPlus touts the superiority of its Li-water chemistry over sulfuryl-chloride, which can react violently with water and release hydrogen chloride and sulfuric acid. “But more importantly,” Visco said, “they have a tendency to explode. So you have an explosion hazard and a disposal problem. It’s quite nasty, but it’s used because people need energy. With our chemistry, you let the thing discharge to the end, and you’re just left with the ceramic plates. There’s nothing else. It’s a completely environmentally benign technology.”

PolyPlus expects to receive its completed pilot line of Li-water batteries by November or December and be piloting them by January 2013. The market for these batteries is quite large in Visco’s estimation. In addition to the aforementioned underwater vehicles, Li-water batteries could power the many thousands of weather and military sensors that get dropped each year, such as the sonobuoys that detect and identify objects in motion underwater.

“We think it should do close to 100 percent penetration in most markets,” Visco said. “Some of the customers we’re talking to are already saying that they don’t want to slowly introduce them; they just want to completely replace their batteries with our technology. That’s rare.”

“We think it should do close to 100 percent penetration in most markets,” Visco said. “Some of the customers we’re talking to are already saying that they don’t want to slowly introduce them; they just want to completely replace their batteries with our technology. That’s rare.”

While Visco said that the cost of materials for the PolyPlus Li-water batteries is “pretty low,” the company will be looking to command the highest price that the market will bear in the initial stages, before scaling to high volumes begins to drive the cost down.

AIR APPARENT

PolyPlus will need its Li-water batteries to succeed in order to establish momentum and reputation for its developing rechargeable Li-sulfur and Li-air batteries. Regardless of which of those technologies finds a niche and takes off first, the plan is to establish the rechargeables first in consumer electronics and then, eventually, in EVs. That’s the path that Li-ion took, and EV battery technology requires too much manufacturing capital and too many recharge cycles to jump straight into that application.

So the unanswered questions for PolyPlus in the EV market are: which technology, and how soon? Although PolyPlus was launched on the backs of its Li-sulfur breakthroughs, its focus more recently had been on the higher potential energy density of Li-air, rather than Li-sulfur, which has a theoretical limit of 2,500 Wh/kg. All that may soon be about to change.

Visco said that PolyPlus had basically shelved Li-sulfur for a while, due to the fact that “when you discharge lithium-sulfur batteries, you end up with a product that comes out a solution, and that limits some of the kinetics of the battery, the power density, and some other things.”

However, early this year, PolyPlus had another breakthrough in Li-sulfur that addressed that lingering problem. The company will announce the news of that breakthrough before the end of the year. As a result, “we’ve refocused our efforts in lithium-sulfur rechargeables. We’re working on both fronts: lithium-air and lithium-sulfur rechargeables.”

Despite that, Visco confirmed that it’s a “reasonable guess” that the PolyPlus Li-sulfur batteries could reach the EV market first. “We’re making rapid progress,” he said. “It’s taken us a while to get to 40 [recharge] cycles on lithium-air, and in a very short time we got to that with lithium-sulfur with the new technology, and actually we’ve gone beyond that.”

While Li-air has a tremendous upside, it also has a more complicated chemistry due in part to the unpredictable make-up of the atmosphere. “If you drive through a desert,” Visco said, “you’ve got to make sure you don’t dehydrate the battery. If you drive through a jungle, you don’t want to pick up too much water. So there’s complexities in water management. But lithium-sulfur is a sealed battery. It’s too early to know which technology is going to win, but we’re betting on both. Lithium-air may find a certain niche and lithium-sulfur a different one.”

Several organizations both academic and corporate (such as IBM and the University of St. Andrews) have also been experimenting with Li-air battery technology, and as IEEE Spectrum reported in July, research groups in Italy, South Korea, and Scotland have achieved 100 cycles with different types of Li-air cells. Despite that, many are critical of Li-air’s potential for the EV market. Materials science expert Professor Stanley Whittingham of Binghamton University thinks that Li-air batteries need too much space for EVs and will be used for large, stationary energy storage, rather than portable applications. He also said, “there’s no electrolyte that currently works well.”

As one might expect, Visco had something to say about Li-air criticisms. Regarding the space issue, Visco remarked, “battery engineers are constrained by conventional auto design and the space allotted to the gas tank in hybrid and plug-in hybrid cars. However, in a fully electric vehicle, designers can utilize the entire car volume (minus the space for the electric drive) to house the batteries, and space is not much of an issue. Assuming that commercial lithium-air is close to (or slightly better than) Li-ion with regards to volume, this should not be a problem.”

There’s also the fact that most Li-air researchers need to use cylinders of dry oxygen, because water from atmospheric oxygen will attack the lithium and corrode it in days or even hours. “If you look at commercial oxygen cylinders, there’s five pounds of steel for every one pound of oxygen,” Visco said. “So it’s kind of silly. It’s just kind of academic fooling around. The reason lithium-air is compelling is because of the possibility of using the same air that we breathe as the positive electrode.”

PolyPlus’s PLE allows a Li-air battery to eschew oxygen cylinders for atmospheric air. The invention also addresses a second big criticism of Li-air batteries: that they are chemically delicate. Critics say lithium gets diverted into dead-end reactions with water or CO2 in the air, so the electrodes may need to be sealed or filtered so they interact only with dry air and the electrolyte.

“Total baloney,” Visco responded. “It is true that some of the competitive efforts will have that problem because they use a vastly inferior technology (no PLE), but this is not a problem for us. PolyPlus always uses unfiltered humid air in its lithium-air cells, with no CO2 problem. We have a patented technology that allows us to use acidic aqueous electrolyte, and acidic electrolytes do not pick up CO2.”

MAKE OR BREAK

Visco of course leaves the door open to the possibility of licensing the PolyPlus PLE, but for now, the plan is to soldier ahead with its manufacturing partners to commercialize its technologies one at a time. The biggest challenge that the coalition of PolyPlus, Johnson Controls, and Corning now faces is building brand-new manufacturing processes without a third-party support network or established supply chain.

“Let’s say you wanted to put up a lithium-ion plant,” Visco said. “You can buy all the manufacturing equipment. There are companies in Japan, Korea, China. You can cherry-pick manufacturing experts and have that thing up and going. The only barrier is capital. If you want to put up a lithium-air or -sulfur plant, we’re it. You gotta come to us. There is no world expertise available; 99.9 percent of the information is at PolyPlus. We’re building a team, but it’s slow going. We have to not only get the technology to cycle well, but make sure that we don’t introduce solutions that are hard to manufacture. It’s the chemistry, the manufacturing, the sourcing of materials, and setting up the supply chain, because it doesn’t really exist.”

In another reference to Li-ion, Visco pointed out that there are many large, reputable sources for the microporous membrane of a Li-ion cell. In the case of a Li-sulfur membrane the only two sources are Ohara, and now Corning. That’s why, when asked how soon a PolyPlus battery – whether it turns out to be Li-sulfur or Li-air first – will make it inside an EV, Visco notes that it took almost 20 years for Li-ion to power EVs.

“Now, in our case I think that can be done quicker,” he said. “But nevertheless, I just had this discussion with Johnson Controls. They think that if we can introduce a commercial rechargeable product in 4-5 years, that we should be looking at EV applications in 10, which would be twice as fast as what was done with lithium-ion. But Johnson Controls is very committed to EV technology. That is their future.”

Is it their future, or is it the future? However long it takes, with the energy densities possible in Li-air and Li-sulfur technology, there is no doubt to Visco that the first PolyPlus batteries in an EV will be capable of the vaunted 500-mil-per-charge range. Hell, maybe they will even crack the 1,000-mile range. And the journey of 1,000 miles begins with a single step. For PolyPlus, that step may require them to walk on water: lithium-water.