This article originally appeared in Issue 60: April-June 2022

Subscribe now

Every new technology must overcome a series of temporary constraints on its way to widespread adoption. Since modern EVs appeared a decade ago, they’ve motored past many of these bottlenecks, (or hurdles, or roadblocks—pick your preferred metaphor). Range has increased, access to charging infrastructure has expanded, and major automakers have (finally) begun to actively market their EVs and to prepare for a new era of mass production.

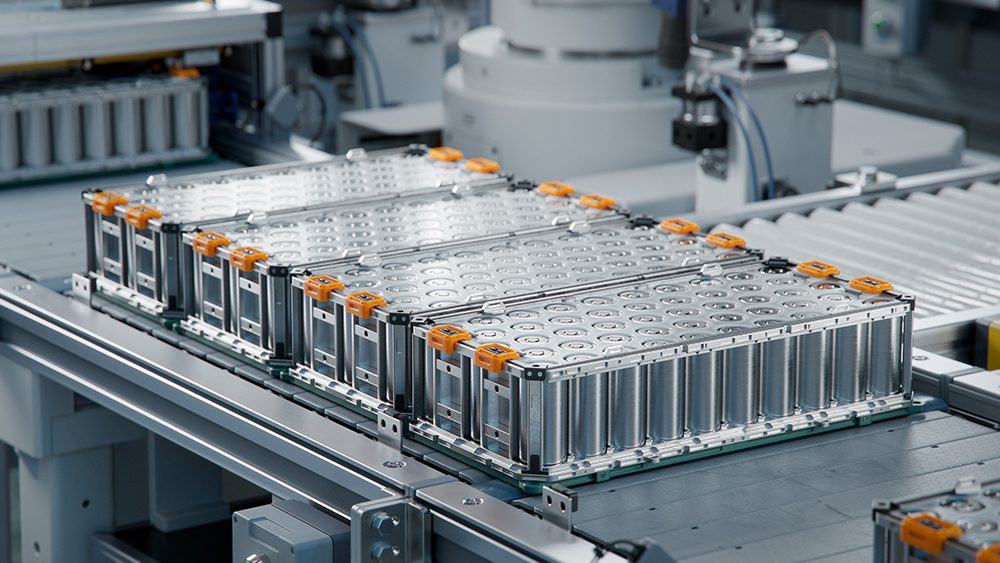

However, the road to the brave new electric future is not yet clear. Newly charged automakers are finding themselves to be production-constrained, as EV trendsetter Tesla has been for some years. They simply can’t ramp up production quickly enough, and this is not only because of the time and investment it takes to build new factories and repurpose production lines—the companies are also dealing with frustrating shortages of batteries and other components.

Current trends indicate that the industry will be able to work its way through the battery supply chain issues within a couple of years. At last count, there were over 300 battery gigafactories under construction or planned around the world. OEMs and startups are also working diligently to develop a circular battery supply chain that prioritizes recycling and sustainability.

However, when we look past the battery roadblock that automakers are now working to remove, we see another one a little further down the highway—this one comprised of raw materials. Charged recently spoke with several industry participants about the issue, and the prevailing sentiment is that the raw-material roadblock will require much more time to clear.

As Dr. Qichao Hu, founder and CEO of Massachusetts-based battery maker SES, recently told us, “It takes about 2 years to build a new battery gigafactory, but it takes at least 8 years (sometimes more than 10 years) to build a new lithium mine.”

The problem is not availability of the minerals, but the time required to scale up production. “Most of the large producing lithium mines around the world already have their offtakes committed to 2026, and the other junior mines have yet to go through exploration, feasibility, permits, and are many years away from production,” says Dr. Hu.

Other critical materials also face shortages. Commodities analysts are sounding warnings about graphite, a critical mineral for battery anodes, as well as nickel, cobalt and a long list of specialty materials.

Farewell to falling prices

We EVangelists have gotten used to smugly pointing to the steadily declining costs of batteries (and renewable energy). Will the raw materials shortage put the brakes on that trend?

Absolutely, says George Miller, a Senior Price Analyst at Benchmark Mineral Intelligence. “The disconnect between demand for critical raw materials and the current supply-side issues means that cell prices on a dollar per kilowatt-hour basis are set to rise this year—the first year in the trend of the modern lithium-ion battery that we will see cell prices reverse, and that’s solely—well, primarily, let’s say—due to raw material prices increasing.”

Cell prices on a dollar per kilowatt-hour basis are set to rise this year—the first year in the trend of the modern lithium-ion battery that we will see cell prices reverse, and that’s solely—well, primarily, let’s say—due to raw material prices increasing.

“Inevitably we will see a slowing down in the rate of decline of battery prices as elevated raw materials prices put the brakes on, temporarily at least,” says Ben Kilbey, Director of Communications and Media at battery manufacturer Britishvolt. “That said, with increased adoption of batteries, alongside improvements in technologies, the [long-term] trend is likely to still be towards lower battery costs and increased affordability, as economies of scale take hold.”

What’s the scarcest of them all?

Our experts all said that lithium is the material that’s experiencing the worst supply crunch, and the market seems to agree. According to a recent report from S&P Global Commodity Insights, the price of cobalt is up around 85%, and nickel about 55%, over the past year, but lithium has really gone through the roof—prices for the light white stuff have surged over 700% since the beginning of 2021.

“In the short term, lithium and graphite are definitely the most at risk of entering shortage,” says Benchmark’s George Miller. “But in the longer term, we see shortages arising for cobalt and nickel products as well. It’s across the whole spectrum of materials involved in the lithium-ion battery supply chain.”

John DeMaio, CEO of graphite supplier Graphex, told Charged that a shortage of graphite looms a little further down the road. “While the cost of the type of graphite used predominantly in EV battery anode materials is 20% higher than it was one year ago, these rising prices are not volatile enough to indicate commodity production shortfalls,” he said. “Currently, graphite supply is adequately serving the demands of consumers and automakers. However, Benchmark Mineral Intelligence is forecasting significant graphite shortfalls from 2025.”

“To close the gap, the supply chain needs to be upsized, diversified and localized,” Mr. DeMaio continues. “To transform graphite from its natural state into EV batteries requires a 3-step process: mining and concentration; shaping and purification; and coating. This path from raw ore to battery anode can involve great distances, geopolitical and logistical risks, and significant time. A key step in accelerating this process is for OEMs and battery makers to engage directly with suppliers down the supply chain all the way to the source.”

We probably need on the order of 40 to 50 copper and nickel projects over the next couple decades—call it roughly two billion dollars of CapEx—to satisfy the demand for electrification.

Shortages of copper and nickel also threaten, but it’s hard to say exactly how wide the deficits will be, because it depends partly on what battery chemistries automakers favor in the years ahead. “The data is tough because a lot of it is reliant on battery chemistry,” James Litinsky, the CEO of MP Materials, said at the recent All-In Summit in Miami. However, he added, “We probably need on the order of 40 to 50 copper and nickel projects over the next couple decades—call it roughly two billion dollars of CapEx—to satisfy the demand for electrification.”

Another area of concern: rare earth metals, which are needed not for batteries but for the magnets used in motors. “Regardless of battery chemistry, magnets need rare earths,” said James Litinsky. “There’s a huge deficit that is looming.”

Litinsky’s company, MP Materials, focuses on rare earths, and he sees the coming shortfall as a major investment opportunity. MP Materials recently bought a rare earth mine in Mountain Pass, California. No other investors seemed to be interested—many players seemed to believe that the competition from China was too fierce—and MP bought it for a bargain price on the courthouse steps.

In some cases, it’s not just the quantity of supply, but the quality of the suppliers, that’s the problem—some supply chains currently originate in countries with poor environmental and/or human rights records, and many stretch across the globe. In some cases, a material is produced in one region, processed in another, and sent on to a third, generating emissions along the way.

“Primary supply sources are concentrated in the Democratic Republic of Congo for cobalt, Southeast Asia and Russia for nickel, and Australia/Chile/China for lithium,” says Litinsky. “In order to support sustainable electrification, the industry will need to secure secondary sources of supply for these materials, domestically. We believe that recycled battery-grade material can help address the risk of these raw material shortages.”

Supply and demand

Of course, the problem is not short supply as such, but rather a mismatch between supply and demand. Brisk sales of EVs are causing the demand for raw materials to grow rapidly, but supply can’t be quickly ramped up. In a sense, the EV industry is a victim of its own success.

We see 20 to 25% per annum growth rates on the demand side of the industry, which is very difficult for an industry like mining, which has long lead times and quite high risk in bringing a project through to production.

“We see 20 to 25% per annum growth rates on the demand side of the industry, which is very difficult for an industry like mining, which has long lead times and quite high risk in bringing a project through to production,” says Benchmark’s George Miller.

Contrary to what the anti-EV crowd would have us believe, the shortages have very little to do with the scarcity of the materials, but with the lack of mining and refining capacity. “All of these critical minerals are geologically abundant, and there are plenty of discovered resources around the world, in fact, enough to supply the industry,” says Miller. “It’s really the lack of investment in the supply side of the industry and the development of those mines running behind schedule that is the problem.”

“Although there is an abundance of lithium in the ground, underinvestment during lower pricing periods has meant we are now experiencing significant bottlenecks in raw material feedstock,” agrees Ben Kilbey of Britishvolt. “It takes on average 5-7 years for a greenfield site to be identified and reach commercial production. Processing of the raw material will also be a potential bottleneck.”

Are there some short-term workarounds that battery manufacturers or automakers can implement to keep cranking out the batteries? No, says George Miller. “In the longer term, battery cell manufacturers can look to research and develop varied cell chemistries that try to avoid some of the rising raw material prices. [However] I would call lithium and graphite really irreplaceable elements in lithium-ion batteries, and these are the two that are extremely at risk of shortage in the short term. So, no, there’s not really a workaround there apart from scaling investment into the industry, but even then, I think it’s more of a mid- to long-term solution to the issue.”

When it comes to how long it will take to build the supply chain the industry needs, Mr. Miller is more optimistic than some. “Probably three to five years would be the timeline that it takes to develop a new mine from greenfield through to production. And we’ve seen a lot more investment into these mines at the moment. What I would say is that lots of these mines are delayed when they come through to production, and have cost overruns and such. So really it needs to be investment across the full spectrum of critical materials, not just lithium and graphite in shortage at the moment, but also cobalt and nickel, which are not as close to shortage, but if we don’t prepare for future demand-side growth rates, then the same issues could arise.”

Rare earth elements, which are important components of electric motors, as well as high-purity manganese and synthetic graphite, can be added to the long list of materials that need to be developed. “The problem is that they’re scaling from what I would call the specialty chemical markets to commodities,” says Miller. “That’s because they’re tailored for the end user, and also because the specifications for these battery-grade chemicals are very, very tight. There’s not an industry standard, like iron ore and copper, that the industry can work to, but rather specifications specific to the end user.”

Time for action

So, enough whining—let’s talk about solutions. What should automakers and battery manufacturers be doing right now?

Nickel and cobalt are high on the list of scarce materials, and this is one reason that Tesla and other automakers are expanding their use of alternative battery chemistries such as LFP. The catch is that LFP cells use more lithium, and their price advantage over NMC/NCA cells has by all accounts been shrinking.

“There is no question that the price of lithium has been rising, which affects the cost of all lithium-ion batteries,” says Tim Poor, President of Advanced Cell Engineering, a Florida-based company that specializes in LFP and LM:FP chemistries. “The cost of battery cells using NMC/NCA chemistries is also being driven higher by substantially large increases in nickel and cobalt prices. LFP cells do not use these expensive metals. They use iron and phosphate, which are plentiful and have much more stable and lower prices.”

In the long term however, the industry needs much more production and processing capacity for a long list of critical materials, and both automakers and battery suppliers (as well as—dare we say it?—governments) need to become much more proactive. Our experts see encouraging signs—companies are investing more in the upstream reaches of the lithium-ion value chain, which will be absolutely essential to bringing on new supply.

“It would be interesting to see cell manufacturers and automakers take larger equity stakes in mining projects, and also chemical refining and component manufacturing projects,” says George Miller.

Investing in mines alone won’t solve the problems—downstream players need to learn more about what goes on upstream. Could we also see a shortage of people with the needed expertise?

“I think there is a strain on the labor market in the battery industry at the moment, but information and knowledge is definitely beginning to flow towards the downstream of the industry,” says Miller, “so there’s definitely more understanding of raw material shortages over the past couple of years.”

Some automakers are “absolutely” moving in the right direction, says Miller. “We’ve seen Chinese automakers be really ahead of the pack here, along with Tesla. I would say Tesla, BYD, Great Wall Motors as well. New companies have been forward-thinking in the way they’ve approached their lithium-ion battery supply chains in partnering with cell manufacturers and even miners to secure the necessary raw materials. Volkswagen as well is definitely beginning to secure quite a lot of its supply. I think those would be the biggest four: Tesla, Volkswagen, BYD and Great Wall.”

“Britishvolt is creating thoughtful and strategic partnerships directly with the raw materials supply chain,” says Ben Kilbey. “Directly sourcing raw materials ensures our high ESG standards are met, at the same time improving supply chain security. We have already achieved this for cobalt with a partnership with Glencore, and [we’re exploring it] with VKTR in Indonesia for nickel. Development of a localized processing ecosystem will be critical, and BV has taken positive steps in closing the loop, reducing our long-term dependence on virgin materials. We also have a recycling JV with Glencore, Britishloop, that will create a UK battery recycling infrastructure.”

Recycling to the rescue

Kunal Phalpher, Chief Strategy Officer of Li-Cycle, stressed the need for localized sources for battery-grade materials. His company is building a hub-and-spoke network of recycling facilities in order to produce recycled material in the regions in which there is demand. “In order to meet the accelerating demand for battery materials, we are confident that recycled material will be key in supporting the ability of EV manufacturers to achieve their production goals,” he told Charged. “It is important to create localized supply chains for key battery materials (lithium, nickel, cobalt) in order to help produce a reliable consistent supply not subject to global supply chain issues.”

“There is no one mine that contains all the metals contained within a battery—recycling can be a very efficient method of sourcing these critical materials,” said Kunal Phalpher. “Also, there is no limit to the number of times the material contained within a battery can be recycled. We call it ‘urban mining’—re-using recovered materials to make new batteries in a truly circular and sustainable manner.” This echoes a famous comment by Redwood Materials CEO JB Straubel, who said that the next big lithium mine could be found in the junk drawers of America.

Li-Cycle is collaborating with Ultium Cells (a joint venture of GM and LG Energy Solution) to recycle the manufacturing scrap that will be produced at its battery plant being built in Ohio. The company will also be working with LG Energy Solution to recycle its battery manufacturing scrap and to supply it with recycled battery-grade nickel. “This creates a truly circular, closed-loop ecosystem within the EV battery supply chain,” says Kunal Phalpher.

How much of the demand for raw materials can be filled by recycling? “We believe that over the next 20 years the amount of lithium-ion battery material that is recycled will grow from roughly 5% to 75% of all of the material available,” says Phalpher. “By 2030, we expect that there will be over 4 million tons of lithium-ion battery material available, globally, for recycling per year. Recycling will be able to return a substantial amount of the material back into the supply chain. Recycling can certainly help ease supply chain bottlenecks in the short to medium term as the industry continues to grow. Li-Cycle currently has the capacity to recycle to up 20,000 tons of material per year. We anticipate having 65,000 tons of global recycling processing capacity in 2023.”

Greening the supply chain

Building a better supply chain will enable automakers not only to sell more EVs, but also to make them cleaner. Mines and processing plants have environmental footprints, and nobody wants them in their back yard—but this doesn’t mean it’s a good idea to locate them all in the Global South and East. Bringing more mines and processing plants to North America and Europe would be a double win. Shipping materials back and forth around the world generates a substantial part of the carbon footprint of batteries, so shorter, simpler supply lines would lower emissions. More domestic production could also make it more likely that extraction and processing facilities would follow environmental best practices.

“I assure you that nickel mining in Russia is not as environmentally friendly as it is in Canada,” said James Litinsky at the Miami conference.“There should be a grand bargain. The environmentalists should say, ‘I accept that we need this stuff, I accept that we don’t want it to be made only in Russia and China,’ and they should loosen up on some of the permitting stuff, and [the drill-baby-drill crowd] need to accept that we need to have really tough [environmental] standards.”

There should be a grand bargain. The environmentalists should say, ‘I accept that we need this stuff, I accept that we don’t want it to be made only in Russia and China,’ and they should loosen up on some of the permitting stuff, and [the drill-baby-drill crowd] need to accept that we need to have really tough [environmental] standards.

Britishvolt’s Ben Kilbey also stresses the importance of localizing production and processing of raw materials. “At present there is a significant overdependence on Asia, particularly for processing of raw materials. Increased localization will play a pivotal role in the success of the green transition. Although commodity resources may still be further afield, the development of flexible processing/refining hubs that can handle different materials will greatly relieve the pressure on the supply chain and lower the embedded carbon.”

Kilbey’s company is in the process of building a network of cell factories around the world—each one located close to auto production and to abundant sources of renewable energy.

The future’s still green

While all the experts we’ve heard from predict challenges and turmoil in the short term, none are pushing any doom-and-gloom scenarios (we’ll leave those to the “better stick with fossil fuels” brigade). As automakers face high prices for the materials they need, they’re taking the necessary steps to increase supplies and, along the way, to shorten and clean up supply chains. After all, that’s how the invisible hand of capitalism is supposed to work.

“As we say, this is an energy transition, not a switch, and building out resilient, domestic, supply chains is a journey,” says Britishvolt’s Ben Kilbey.

“Investment styles are cyclical, just like industries. The cure for high prices is high prices,” says James Litinsky. “We will solve this problem.”

This article appeared in Issue 60: April-June 2022 – Subscribe now.