Microvast is the largest battery company you’ve probably never heard of. That’s because they are their own best customer. Instead of pitching their proprietary lithium–titanate technology to vehicle builders, the company identified a well-suited niche for their batteries and set out to demonstrate a sustainable model.

Primarily a research and development focused chemical company, Microvast took a bold move when they purchased Hengtong Bus, one of the largest bus makers in China with annual production of around 5,000 buses.

By focusing on commercial fleets, Microvast wants to show utility companies that they will be the biggest beneficiaries of electric vehicles. “If there is a technology that enables [utilities] to sell electricity to the vehicle owners directly – similar to the gas station model, at a very high rate – we will see a joint development of the market by both car companies and utilities,” explains Lance Deng, Microvast’s head of corporate strategy.

Lithium–titanate

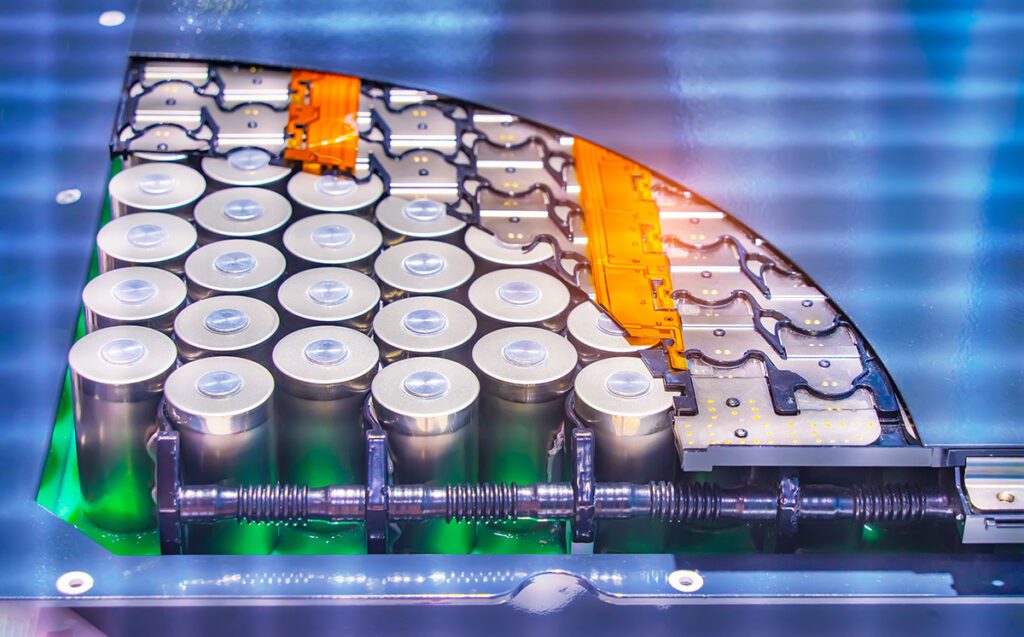

Since 2006, Microvast has primarily focused on advancing lithium–titanate (LTO) technology as a replacement for conventional lithium-ion cells. Widely regarded as one of the best choices for the next generation of batteries, LTO cells use nanostructured lithium-titanate instead of carbon to cover the surface of the anode. The result is increased electrode surface area, allowing for two key advantages over today’s commercially available cells: charge/discharge capacity and cycle life. Lance tells us that by using their R&D experience, they have been able to produce a special cathode, anode, and separator to make one of the most advanced LTO batteries, while eliminating some the chemistry’s weaknesses. “We have patents for all those important elements of the battery.”

Before focusing on battery research, Microvast engineers developed reverse osmosis membrane technology for water filtration, which they sold to Dow Chemical. “By adopting some of the knowledge and skills we had to manufacture those membranes, with the highest possible quality you can find on the water filtering market, we’ve been able to produce a new type of separator that allows very efficient delivery of electricity in the battery.”

To complement their specialized separator design, Microvast claims proprietary anode and cathode developments that have resulted in battery specs “better than any known LTO battery performance on the market.”

Other LTO pioneers include Toshiba, which supplies batteries for the Mitsubishi i-MiEV and the Honda Fit EV, and Altairnano, whose cells can be found in Proterra’s EcoRide BE35 – an all-electric 35 ft bus. Lance says while these companies use similar LTO chemistries, their cathodes and anodes are completely different, and Microvast’s recent advancements have enabled them to push the chemistry to new limits.

Cycle life

A battery’s cycle life – the number of complete charge and discharge cycles before the nominal capacity falls below 80% of initial rated capacity – is critical in determining its viability for mobile applications. A higher battery pack cycle life means a longer vehicle life span and a lower overall cost of ownership.

This is where Microvast promises their cells excel – a life of over 20,000 cycles (with 100% Depth of Discharge and 4CC/4CD conditions). By comparison, today’s lithium iron phosphate (LFP) cells have a life of around 2,000 cycles, under similar charge conditions. And Toshiba’s lithium-titanate oxide Super-Charge Ion Battery (SCiB™), used in the Mitsubishi i-MiEV, offers a life of around 6,000 charge/discharge cycles.

Charge/discharge rate

Microvast also boasts that their technology can endure a highly intensive charge and discharge rate without damaging the cells, on the order of 5-6 times the rate at which LFP cells safely operate. That means a vehicle fitted with Microvast batteries could be fully charged in a matter of 5-10 minutes, assuming you have one heck of a mega-ultra-super-fast charger and power source available.

Those are impressive specs, if they can live up to independent tests and real-world trials. But when talking EVs, arguably the most important question is: At what price and weight?

Lance tells us that price is roughly the same compared to LFP in today’s market. However, the energy density is about 15-25% less, a trade-off that could be absorbed given the right application, and to Microvast that application is buses.

Engineering notes: The lithium-titanate battery

Advantages

The main advantages LTO batteries hold over other commercially available lithium chemistries – like LFP – include superior charge and discharge power capabilities, cycle life, operating temperature range, and thermal event safety.

Disadvantages

Areas where LTO falls short include energy density and gassing. The electrode potential of LTO is about 1.4iV higher than graphite. So the voltage of Nickel Cobalt Manganese (NCM)-graphite is 3.6 V while NCM-LTO is only about 2.2 V, which means you need more LTO batteries in series to reach the same energy requirements. However, Microvast says they have recently updated their production cell design, and the nominal voltage changed from 2.2V to 2.3V for the newly developed cells – an increase of about 5%.

In charge/discharge cycles, organics in the electrolyte will react with the cathode/anode and generate gas that results in swelling of the cell and loss of battery performance.

Fleets

Commercial fleets that run route-based operations are ideal for electrification. The predictable route allows for optimal battery pack sizing, so that the capacity will precisely meet the range needs.

Microvast found their LTO technology was particularly well suited for city buses whose daily routes include 10-15 loops, with short stops at central depots.

In their model, each electric bus only has to be fitted with enough battery capacity to sustain the operation of one loop of around 10-15 miles. Every time the bus comes back to the terminal station it can be quickly charged in about 5 minutes.

In contrast, an electric bus outfitted with LFP would need enough battery capacity to run the bus for around 50 miles, because the technology doesn’t allow the batteries to be charged as quickly. This means a heavy and expensive battery pack – in some cases more expensive than the bus itself.

Another issue with LFP is the 1,000 to 2,000 charge cycles. If a bus is doing one deep charge cycle per day, the batteries will begin to wear out after 3 to 4 years of operation. An average bus has a life expectancy of 12-14 years, and within the life of the electric bus the operator will have to replace a LFP battery, which again is a huge cost. If it is not a demonstration or some political requirement, that operator will not likely see a financial benefit from that bus.

Because their new LTO battery has a much longer life expectancy and a much greater charge and discharge capacity, Microvast believes they have created a more sustainable model.

With a battery pack that is sized only for the range of one loop (plus a little cushion), the size is roughly 1/10th that of an LFP pack sized for a full days use. And even if the buses charge 10-15 times a day, the batteries will still last 8-12 years, dramatically reducing cost.

“So in our model, the battery cost for the life of the bus is roughly 1/20th of other existing choices. We’ve done quite a lot of different case studies in the US and other countries, and owners and operators can actually get additional net profit for making the switch from a fossil fuel vehicle to a pure electric vehicle. As opposed to other electric bus options available right now, where owners will see a net loss at the end.”

UltraFast

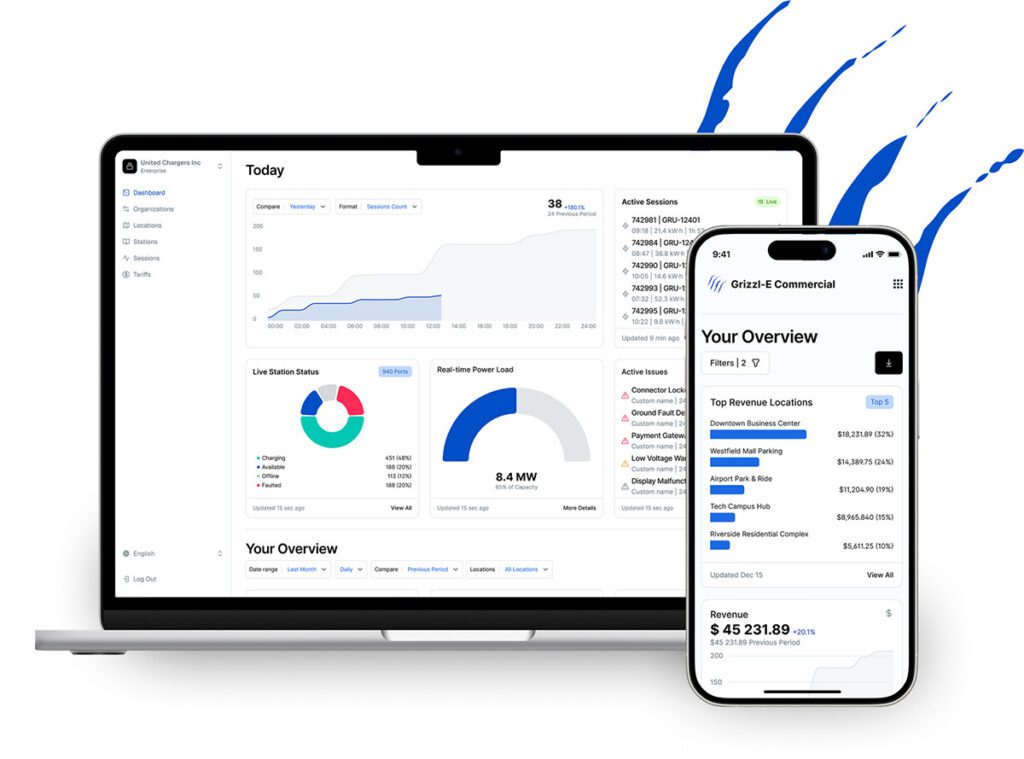

One of Microvast’s main goals is to help utility companies get into the EV market more efficiently. The company believes electric utilities could provide the biggest push for widely deployed EVs.

“The UltraFast charge station works just like common gas stations and allows electric buses, and in the future passenger cars, to fill up very quickly and serve many vehicles in a short period of time,” explains Lance. “This is an exploration into a viable new business model that opens the door to utility companies who realize the big potential of the trend of electric vehicles in the future, and want to build themselves into the future gas company-like giants that sell large amounts of electricity on the road-side charging stations.”

Their first operational city bus system is already underway with the full backing of China’s State Grid, the largest utility company in the world.

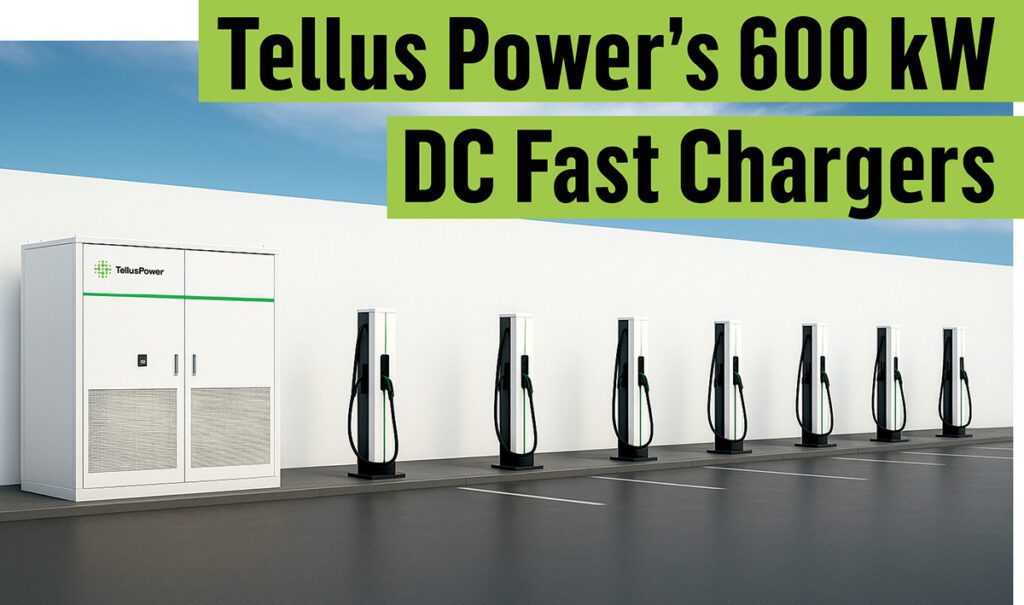

The company has already delivered 250 UltraFast charging BEV and PHEV buses in Chongqing, China, the country’s fourth largest city. Currently there are two commercially operational central charging terminals, operated by State Grid, one with two charging points and another with six. Each charging point delivers a whopping 400 to 450 kW.

The initial fleet of six buses, which officially went into service in March 2011, each racked up over 24,000 miles by June 2012. They service a route with a 24-mile loop, and are charged six times per day. In that time the company claims less than 1% capacity loss, and expects a life of well over 15,000 cycles.

Lance tells us that it is full speed ahead for future deployments. “China State Grid is working very closely with us. They would like to promote this method to multiple major cities in China for commercial fleets, especially city transit buses. Very soon in China we will have four [charging] locations operational.”

This year, Microvast has been given an order for another 500 buses, and next year expects to deliver an additional 1000 buses for these particular cities.

“It’s pretty amazing to see our model in action and working so well.”

Lance says they are looking at many different markets, but haven’t had much time to deeply explore other territories. “We have received a lot of interest from different cities in the US and Europe, but we have yet to employ our system here [in the States].”

“The US utility system is pretty complicated. You don’t have unified forces to understand and promote this type of new business model. Because China is a fairly open country to new technologies – especially electric vehicles – we have been able put more than 100 buses with our system in China since 2011, and have been commercially operating them for more than one year.”

There are a lot of commercial fleets with similar operational patterns that could benefit from this type of new model should it ultimately prove successful. Lance explains that the company is in talks with “a few big names” in commercial vehicle powertrain systems to develop a suitable turnkey solution for bus builders here in the US.

In the meantime, the R&D arm of the uniquely vertically integrated company will continue to push the limits of existing battery chemistries while exploring the possibilities of new mixes. “That is where our strength lies.”

This article originally appeared in Charged Issue 4 – AUG/SEP 2012