With a longer range and a lower price, the 2013 Nissan LEAF screams upgrade, but it’s only one small aspect of the company’s aggressive EV strategy. Proprietary, localized manufacturing and improved infrastructure also play key roles in Nissan’s plan for world domination electrification.

Sometime back in the 60s, Mr or Mrs Ghosn must have put in the mind of a young Carlos the proverbial notion “if you want something done right, do it yourself.” Of course now, Carlos Ghosn is Chairman and CEO of Renault-Nissan, the most ambitious global automaker in the transition to electric vehicles. Not content to simply produce the bestselling EV yet, the Nissan LEAF, the automotive powerhouse insists on manufacturing its own batteries, localizing assembly of its cars, creating its own DC fast chargers, and helping to build the charging infrastructure on at least two continents: Europe and North America.

Nissan’s holistic approach to the EV transition sounds like Robert Rodriguez’s do-everything approach to making movies. But while manufacturing and infrastructure are important, that’s all behind-the-scenes stuff. The cars are the real stars of the show. They’re the ones that put butts in seats, so to speak.

Nissan opened 2013 with its new LEAF. Hoping to put the LEAF’s previously lackluster sales behind it, Nissan capitalized on energy efficiency and its new American assembly plants in Tennessee to offer a car with, among other details, a longer range for a lower price. With three model grades to choose from, and assuming a $7,500 federal tax credit, the 2013 LEAF S can be had for just a hair more than $21,000. That attractive price, along with a new marketing strategy, will be the foundation for the LEAF’s 2013 sales. Will Nissan be raking in the profits from a bushel of LEAFs by the fall? If so, it may be because Nissan found a way to finally address the related EV concerns surrounding range, batteries, and charging.

Loose LEAF Sales

Loose LEAF Sales

The particulars of the 2013 LEAF include a selection of three model grades, all of them offered at a reduced price from the 2012 LEAF. The entry-level LEAF S grade shaved a substantial $6,400 off the cost to drivers. And despite including the same 24 kWh battery as the old model, the 2013 LEAF offers a significantly increased range. Nissan accomplished that feat through improved aerodynamics, increased energy recapture from regenerative braking, and better energy management.

One specific source of the new LEAF’s energy efficiency comes from a new hybrid heating system. Previous LEAFs used a legacy heating coil system left over from ICE cars. But, as Brendan Jones, Nissan’s director of EV marketing and infrastructure development, put it, because the old LEAF’s heat coil was not drawing heat from the engine block, the car was using the coil more like an inefficient space heater in a house. The new LEAF uses a new heat pump system instead, which Jones said is about 33 percent more efficient.

New model options with different trims, new colors, and more importantly, a longer range for a lower price, are all factors that Nissan would like to see contribute to an uptick in LEAF sales. As spring began and this issue went to press, Nissan announced its best month since launch with 2,236 LEAF sales in March.

While the LEAF exceeded 50,000 in worldwide sales in February, Nissan has been slammed in the press for not meeting its initial LEAF sales projections. For example, 9,819 LEAFs sold in the United States in 2012 – a far cry from Nissan’s goal of 20,000.

This year, Nissan might nip the backlash in the bud by not releasing sales goals for the 2013 LEAF. It hasn’t so far, but the company obviously would like higher sales. That journey to increased numbers will require more complicated directions than just a better car at a better price. It also involves strategic marketing, dealer education, and a continued commitment to building charging infrastructure.

“We knew we were going to have a ramp-up period,” said Jones. “We knew our sales from the beginning as we came out of the Oppama plant in Japan were going to be limited to some degree, although we did have high expectations. The transition plan was always to fulfill our commitment to reduce as much cost as we could. I think our repositioning on price is our first statement towards better sales on Nissan LEAF. We have solid plans for the vehicle and will not in any way back off our leadership position in sales and infrastructure support. We’re very bullish.”

However, it’s not yet a mainstream enough vehicle to be marketed the same way as say, a Nissan Altima.

“LEAF is different, because you don’t go on a national media campaign,” Jones said. “Right now, our media campaign is very targeted and specific to markets in which electric vehicles are selling, the ‘opportunity markets’ in which we believe the vehicle will sell, and then as we’re fond of saying, ‘the rest.’ Most of the rest is from a few interesting customers, but not in a robust EV market.”

At a small meeting in January between LEAF customers in Phoenix and a few Nissan executives, Andy Palmer, Executive Vice President and frequent LEAF spokesman, addressed some things that Nissan has changed according to customer feedback, including some marketing tips. “We’ve changed the marketing from something that’s ‘good for you,’ to something that’s fun,” Palmer said.

In other words, Nissan is beginning to address a long-standing problem that Dean Devlin, producer of Who Killed the Electric Car? famously pointed out, that marketing EVs as “medicine” simply doesn’t work.

At that same Phoenix meeting with Palmer was Billy Hayes, VP of Global Sales for the LEAF, a position he only gained last October. A big part of his new job requires working with dealers on EV education and creative ways to compensate dealers for the extra time and effort often needed to sell electric cars. Certain online surveys and first-hand reports have raised suspicion in the EV industry that some car dealers don’t know much about the EVs and PHEVs on their lots, and may even be steering customers away from plug-in vehicles. Last year, Al Castignetti, VP of Sales for Nissan, admitted that the company didn’t prepare dealers properly for the LEAF.

“We’re in the process of offering updated training for the dealers,” Hayes told his Phoenix audience. “We’re putting in things to control the customer experience as best we can at the dealer level. As we get more volume out there, the dealers become better and better at handling the sales experience. If I’m a salesperson, it’s easier for me to sell three Altimas than one LEAF. It’s a complicated sale. But it’s not a disincentive for a dealer to sell a LEAF. A lot of them believe it’s the future.”

Palmer also hit upon another reason why LEAF sales have been slow in the US, which is a lack of charging infrastructure. “I know I can drive across the whole of Japan and know that I’ll always be within 20 km of a fast charger,” he said.

The Charging and the Charged

Recent data from the DOE shows that government agencies and private owners are adding about 180 public chargers a month to the country’s growing infrastructure. At the time of the March 15 report, the US had 5,548 public chargers, and if the current pace continues, the country will have in the range of 7,400 by the end of 2013.

No one knows for sure how many chargers it will take before the range-anxious exhale a collective sigh of relief and begin buying more EVs, but you can’t fault Nissan for standing on the sidelines. The automaker plans to accelerate the adoption of DC fast charging stations worldwide with its own quick charger that it began rolling out more than a year ago. Nissan’s 480 V DC fast charger is about half the size of some of its competitors, and starts at about half the price – less than $10,000. It can take a LEAF from zero to 80 percent charge in about a half an hour.

At the Washington Auto Show in January, Nissan announced plans to bring 500 of the charging stations to the US in a year and a half, which could as much as triple the total number of such stations in the country today. Forty of those stations will be installed in the DC area, in collaboration with eVgo. With its customers’ driving patterns coming straight from the LEAF data, Nissan could play a key role in determining the placement of the chargers.

At the Washington Auto Show in January, Nissan announced plans to bring 500 of the charging stations to the US in a year and a half, which could as much as triple the total number of such stations in the country today. Forty of those stations will be installed in the DC area, in collaboration with eVgo. With its customers’ driving patterns coming straight from the LEAF data, Nissan could play a key role in determining the placement of the chargers.

“We work with our partners on that,” Jones said. “Our role is advisory. We don’t mandate; we consult. Thus far, we’re 182 chargers in, and they’re in very good locations. Of course, it benefits the network providers to put them where the customers are.”

These quick chargers use the CHAdeMO standard, which works with autos such as the LEAF and Mitsubishi i-MiEV, but not the Chevrolet Volt, which sold more than 23,000 last year.

Palmer has said that Nissan obviously wants to encourage CHAdeMO use, and that the company strategy is to make it the de facto standard by putting enough chargers out there that everyone else has no choice but to support it. Nissan hopes to sell 2,000 of its DC fast chargers worldwide by 2014.

Yet even if we were to make DC fast chargers the new phone booth – besides being economically unviable – that wouldn’t address the entire EV range conundrum. The large majority of plug-in drivers will charge up at home overnight, so there also needs to be better public understanding and confidence in an EV’s batteries and range.

“Fact number one is that the average American drives 20-29 miles a day,” Jones said. “The average Nissan LEAF driver drives 31 miles a day. So it is a five-passenger, no-compromise vehicle that has 2.5 times-plus the range of what a normal American driver does on a daily basis. It’s a very suitable vehicle. But we know from a lot of research and analysis and direct customer interviews that Americans think they drive more than they do, and they equate time in the vehicle to miles driven. Well, as we know, with EVs, if you’re just in the vehicle for five hours, you might have as much charge five hours later. Unlike an ICE, where you’re going to be burning gas the whole time. If you’re not engaging the gas pedal, you’re really not depleting the charge. There you go, even I said ‘gas pedal’ [laughs].”

“Fact number one is that the average American drives 20-29 miles a day,” Jones said. “The average Nissan LEAF driver drives 31 miles a day. So it is a five-passenger, no-compromise vehicle that has 2.5 times-plus the range of what a normal American driver does on a daily basis. It’s a very suitable vehicle. But we know from a lot of research and analysis and direct customer interviews that Americans think they drive more than they do, and they equate time in the vehicle to miles driven. Well, as we know, with EVs, if you’re just in the vehicle for five hours, you might have as much charge five hours later. Unlike an ICE, where you’re going to be burning gas the whole time. If you’re not engaging the gas pedal, you’re really not depleting the charge. There you go, even I said ‘gas pedal’ [laughs].”

There is a LEAF range-estimating tool under the LEAF section at Nissanusa.com that uses Google Maps to help you calculate the mileage for your daily commute, adding as many stops as you need. Nissan is also helping to develop a smartphone app for people currently driving ICEs to determine their daily driving range and then see if an EV is right for them. This app was not yet available at press time – it’s a separate app from the already available iOS and Android Nissan LEAF app, which lets the owner control certain aspects of the car’s charging, climate control, and other systems.

Another ongoing concern for potential EV buyers is certainly the battery life and its performance over time. Hopefully, no one ever walks away from an EV sale believing the battery will perform like new for the life of the car. But neither do EVs have warnings emblazoned on the driver-side door, like the Surgeon General’s warning on a pack of cigarettes: “Expect 80 percent of battery capacity after five years. Battery degradation begins soon after the first use and then plateaus for a while.” Yet that’s the gist of Andy Palmer’s message to customers.

Nissan found itself in a little bit of hot water over the hot air in Arizona, and how it has degraded the lithium-ion battery performance for some otherwise satisfied LEAF customers even faster than expected. Many customers complained of being down to two thirds or less of their original range after less than two years of use; that their dealer did not inform them of any increased battery degradation from the extreme desert heat; and that liquid-cooled batteries in other EVs may do a better job of preserving the battery in the desert than the air-cooled LEAF battery.

Palmer defended the air-cooling method, but also conceded that “we’re learning as we go along. Not everything we do can be validated in the laboratory. That’s why we’re here.” Also, customers whose batteries have verifiably less than a certain threshold of capacity within the warranty period can have the battery replaced (at great cost to Nissan).

Automaker, Batterymaker

Automaker, Batterymaker

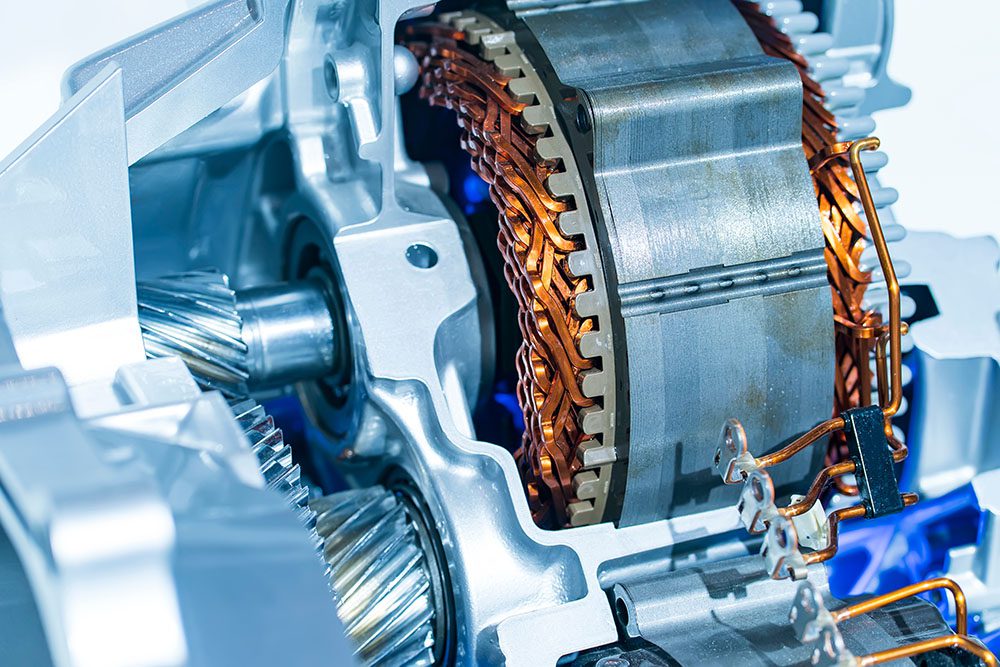

The silver lining to this is that any lessons Nissan learns from such battery difficulties it can employ immediately, since it makes its own LEAF battery packs in its Smyrna, Tennessee plant that launched last December. “Every time we look at an iteration of the battery, we try to improve it,” Palmer said. “It will be a continuous development. There’s no magic bullet to the chemistry.”

The Smyrna plant will have to move a lot of widgets to begin paying off a DOE loan of up to $1.4 billion, which Congress authorized as part of the Energy Independence and Security Act of 2007. The facility includes not just a battery plant, but also a LEAF assembly plant, where the 2013 models are currently rolling off the lines. This venture has created at least 300 manufacturing jobs so far. If it gets going up to full capacity, which is estimated at 200,000 battery packs and what Palmer quoted as 150,000 LEAFs per year, at least 1,000 more jobs would be in order. This all fits into Nissan’s overall strategy of producing 85 percent of all Nissan and Infiniti products that are sold in the US in North America by 2015.

The Smyrna plant will have to move a lot of widgets to begin paying off a DOE loan of up to $1.4 billion, which Congress authorized as part of the Energy Independence and Security Act of 2007. The facility includes not just a battery plant, but also a LEAF assembly plant, where the 2013 models are currently rolling off the lines. This venture has created at least 300 manufacturing jobs so far. If it gets going up to full capacity, which is estimated at 200,000 battery packs and what Palmer quoted as 150,000 LEAFs per year, at least 1,000 more jobs would be in order. This all fits into Nissan’s overall strategy of producing 85 percent of all Nissan and Infiniti products that are sold in the US in North America by 2015.

That localized production can also play an important part in keeping its EV prices falling to a level that’s comparable with ICEs, because as Hayes pointed out in a Nissan video in February, beyond early adopters, car buyers don’t want to pay much extra for green technology.

Last year, Palmer spoke about how there were some initial challenges for the Smyrna facility to master the mass production of batteries, train the work force and ramp up to full volume. Now that the lines are humming along, Jones sees it as a success.

Last year, Palmer spoke about how there were some initial challenges for the Smyrna facility to master the mass production of batteries, train the work force and ramp up to full volume. Now that the lines are humming along, Jones sees it as a success.

“It was just the assurance of quality,” Jones told us. “We were taking it slow, because of that. It was a new facility; it still is. It was the first time they ran battery packs down through the line in the brand new facility, and they went through the normal quality checks that we do with any vehicle or any new commodities that come out of a brand new assembly plant. None of it was unusual, unplanned, or anything like that; it’s all very typical to the quality methodologies Nissan has been known for over the years. We’re ramping up. The battery plant has a lot of capacity; we’re not utilizing it all yet, but it is there as we continue to increase sales over time.”

“It was just the assurance of quality,” Jones told us. “We were taking it slow, because of that. It was a new facility; it still is. It was the first time they ran battery packs down through the line in the brand new facility, and they went through the normal quality checks that we do with any vehicle or any new commodities that come out of a brand new assembly plant. None of it was unusual, unplanned, or anything like that; it’s all very typical to the quality methodologies Nissan has been known for over the years. We’re ramping up. The battery plant has a lot of capacity; we’re not utilizing it all yet, but it is there as we continue to increase sales over time.”

All of that unused capacity might suggest an opportunity for Nissan to take orders for battery production from other businesses, but the company is not currently commenting on that possibility. There’s also the possibility that Nissan could produce different types of batteries in the same plant, should the company evolve the battery systems for future EV models. As Palmer told his customers in Phoenix, “please don’t get religious about the type of battery. There are hundreds of technologies that are available.”

All of that unused capacity might suggest an opportunity for Nissan to take orders for battery production from other businesses, but the company is not currently commenting on that possibility. There’s also the possibility that Nissan could produce different types of batteries in the same plant, should the company evolve the battery systems for future EV models. As Palmer told his customers in Phoenix, “please don’t get religious about the type of battery. There are hundreds of technologies that are available.”

Jones added that the state-of-the-art Smyrna facility should be able to handle whatever new technologies or chemistries are required. “Fortunately or unfortunately, depending on your perspective, lithium-ion batteries are as different as cars are different, in terms of the way they’re made. We’re going to continue to improve on the battery technology and the performance of batteries. There are processes in place to do that. We do have that flexibility, and our teams are actively working on that. It behooves us to make them more efficient and get more energy out of a battery. You can achieve that in a variety of ways: making the inter-related systems in the vehicle work more efficiently (which we’re doing in the 2013 LEAF), making the battery yield more energy per cell, and from the chemistry of the battery.”

Infiniti LE and Beyond

Assessing the state of the LEAF or of the entire field of EVs comes down to individual perspective. One can see the Nissan’s missed sales projections as a sign of failure, or one can see the LEAF as far and away the most successful pure electric vehicle in history, which it is, with well over than 50,000 worldwide sales.

You could also see EVs as a whole as failing to capture the attention of the public at large, due to slower-than-hoped-for-sales, or you could see an industry still in its infancy, but a healthy baby that’s getting bigger and stronger with every year.

You could also see EVs as a whole as failing to capture the attention of the public at large, due to slower-than-hoped-for-sales, or you could see an industry still in its infancy, but a healthy baby that’s getting bigger and stronger with every year.

For Nissan, it’s still full steam ahead. The electric Infiniti LE was previously slated for a launch sometime around April 2014. While Nissan would not give Charged any update related to the launch, Jones confirmed that they’re moving forward with it, and Palmer exclaimed last year than the Infiniti LE is “gorgeous. You’re taking LEAF underpinnings – a hatchback – and reengineering that for a sedan has been very challenging. I launch 51 cars in the next five years, and that car’s my favorite.”

Jones also believes that the Infiniti LE will be in a different class than the Tesla Model S. “Tesla’s really going high-end,” he said. “They’re right now between the $90,000 and $110,000 price point. We’ll compete below that.” Specifically, Jones called the Infiniti LE a $60,000+ vehicle, which he thought would appeal both to LEAF owners who want to move up to a more luxurious car, and to current ICE drivers who don’t want to sacrifice their standards. “We see a lot of synergy both with our own vehicle lineup, and with the general public on looking at an affordable four-door, no-compromise, EV sedan,” he said.

Jones, Palmer, and Hayes have all recently talked about how the increase in competition in the EV field will eventually, if not immediately, help Nissan and the general transition to electricity.

In the February video, Hayes mentioned that Ford’s recent decision to expand its electric offerings from 200 dealers to 900 could be a “threat,” but that overall, more OEMs entering the EV market will help Nissan stay competitive, relevant and current. “The more EVs we can get out there, the more infrastructure will get built, and the more acceptance there will be in general,” he said.

“This is a fun topic,” Jones said. “Whether you’re negative or positive about EVs, writers love to write about it either way. It certainly has a lot of emotion around it. But we have to love the amount of OEMs that are coming into the space.” Jones mentioned the Fiat 500e coming in the second quarter of 2013 with a 108 MPGe highway rating, and the Volkswagen e-up!, with a range of 90 miles. “There’s no question that the market is growing. Now from Nissan’s perspective, we’re the clear-cut leader. We build our own batteries; we have our own assembly plant; we have a decided investment for volume, more so than anyone else.”

“This is a fun topic,” Jones said. “Whether you’re negative or positive about EVs, writers love to write about it either way. It certainly has a lot of emotion around it. But we have to love the amount of OEMs that are coming into the space.” Jones mentioned the Fiat 500e coming in the second quarter of 2013 with a 108 MPGe highway rating, and the Volkswagen e-up!, with a range of 90 miles. “There’s no question that the market is growing. Now from Nissan’s perspective, we’re the clear-cut leader. We build our own batteries; we have our own assembly plant; we have a decided investment for volume, more so than anyone else.”

Palmer echoed similar sentiments, both regarding the growing amount of healthy competition, and Nissan’s commitment to EVs. “The most efficient solution is simply competition,” he said. “More cars out there, more manufacturers pushing the technology. We spent $4 billion developing the LEAF, so I guess we’re ‘all in.’”