Maxwell looks to leverage its early ultracapacitor experience into a ubiquitous, low-cost, high-volume complement to batteries.

Power sources like internal combustion engines and advanced battery packs work great as continuous suppliers of energy. But during the highest peak loads, both sacrifice efficiency attempting to meet the power delivery demands. And pushing these devices to their power limits inevitably affects their lifespan. That’s where ultracapacitors (ultracaps) can earn their keep.

Compared to lithium-ion batteries, there are three characteristics that best describe the advantages of ultracaps: extremely high charge/discharge rates (power density), extremely high cycle life (approaching one million cycles), and great performance at low temperatures. The one feature they lack is the inability to store large amounts of energy (energy density). In other words, they are really great at repeatedly absorbing and delivering huge bursts of power, over long lifetimes and wide temperature ranges, while leaving the large energy requirements to batteries.

Ultra or Super, Either Way It’s Impressive

Ultracaps are relatively new devices that have really become commercially available only in the past decade or two. Also known as supercapacitors, their incredible power density is due to the fact that their internal resistance is very low. So low that when an ultracap is fully discharged, it looks like a short circuit to a charging device (for example, a 3,000 farad cell has about 0.2 milliohms of resistance). The power density – while not as high as standard electrolytic capacitors – is much higher than the typical battery energy storage devices, and many other electrical energy storage technologies.

The long lifetime of the device is due to the “non-faradaic” nature of the charging process, in which (ideally) no electrons are transferred between materials. Instead, during charging, ultracaps store energy as an electric field built up in the electric double layer. In contrast, batteries (aka electrochemical storage cells) undergo chemical reactions to store energy, some of which are irreversible and lead to inherent continuous lifetime degradation mechanisms.

Imperfections in the real world – in the form of material impurities and in the processes used to build ultracaps – are what ultimately limit the devices to finite lifetimes, because the impurities will eventually react electrochemically. Improving the material purity for the active electrode, separator, and electrolytes could lead to even longer lifetimes. In current applications, hundreds of thousands of cycles are expected, and beyond one million cycles is not unheard of.

The other key advantage is the ability of ultracaps to function at low temperatures, all the way down to minus 40º C, with an almost imperceptible change. With batteries that are relying on a mass transfer processes, low temperatures can severely affect their performance.

Max Potential

Founded in 1965, Maxwell Technology has become a clear leader in the new ultracap market. The company only began working with ultracaps in the mid-1990s, but through a combination of technology and market development it has grown that segment of its business from $17 million in 2007 to $97 million in 2011.

Charged caught up with Michael Everett, Maxwell’s Chief Technology Officer, to get his thoughts on the future of the ultracaps market and where they fit into the automotive industry. “I joined Maxwell in 2002. At that time, ultracaps started to become known in the automotive and heavy transportation world, like trucks and buses. There were some hybrid buses already out on the road with ultracaps in 2002,” explained Everett. “But really the market hadn’t developed, and the products were very expensive to produce, although still very capable.”

Maxwell’s main focus remains the same over 10 years later: to drive out costs. So far it’s been successful. “Through a lot of technology advancements, both in the fundamental technology of the devices as well as manufacturing methods and processes, we have been able to reduce the cost dramatically – call it an order of magnitude in a decade,” said Everett. “From a place where people couldn’t afford to even consider using ultracaps in anything but an experimental mode, to where we have high-volume production going into transportation applications around the world.”

Scaling up the operation in recent years has certainly helped to bring down the price, but engineering ingenuity has played a major role as well. Back in 2002, Maxwell purchased Montena Components, which at the time had a film electrode-based ultracap on the market. But Maxwell had developed a packaging technology that was more advanced. By combining and improving on the two designs, Maxwell was able to reduce the number of parts in the new device from about 20 to about seven. Maxwell went on to continually push for simplification in search of high-volume, lower-cost manufacturing processes.

Another major breakthrough was in the electrode. “Maxwell’s ultracap electrode, we believe, is one of a kind, in the sense that our manufacturing process is completely dry,” Everett explained. “We make carbon film electrodes without any liquid additives, and I think that’s very unique in this industry. Everybody else is using the techniques that are employed in the lithium-ion battery industry – wet coated electrodes, mixing with solvents, then coating it onto a current collector foil and allowing it to dry. Not putting that solvent in there, not having to work with dryers, not having to reclaim solvents, all adds up to a huge advantage for costs. Throw in a little bit of volume, and you’ve got an affordable device.”

Automotive Inroads – Stop-Start

With an affordable, highly-capable power storage device come customers. In 2010, Maxwell announced that it would supply ultracaps to Continental AG, one of the world’s largest automotive suppliers, for its voltage stabilization system. The Continental device made its way into PSA Peugeot-Citroën’s second generation stop-start system that’s found in diesel models including the Citroën C4 and C5. Now, there are more than half a million cars on the road with Maxwell ultracaps in them, and by Everett’s estimation they’re off to a great start.

“To my knowledge there hasn’t been one single ultracap return from that system. It’s functioning extremely well. There have been comparisons of stop-start systems in Europe from all the major automakers, and that system came out number one for driving comfort and performance. It’s obviously not all due to ultracaps, but the ultracaps are so capable at cranking the engine after a stop – it happens so fast and so efficiently and so many times in all kinds of weather – that now it is viewed as a very dependable and useful system.”

Continental uses two of Maxwell’s ultracaps designed into a small module, basically 5 V in series with the battery that is used to stabilize the power net and provide cranking power when the engine starts.

“When the cranking event occurs, the power comes from the ultracaps and the voltage of the system stays well above 10 V,” explained Everett. “Whereas with a battery-only system, the boardnet voltage will generally dip to 8 V. So, with ultracaps you don’t get the processors resetting, all the lights dimming, and other disruption when the start function occurs.”

Hybrid Buses

Ultracaps seem well-suited for stop-start vehicles, where explosive market growth looks to be inevitable by most accounts. Currently, however, Maxwell’s highest-volume application is hybrid buses, with more than 10,000 ultracap-outfitted units now deployed in China alone.

The bus systems typically house somewhere between 400 V and 700 V of ultracaps in series. When a bus grinds to a halt, the tremendous amount of kinetic energy is captured by a regenerative braking system and stored in the ultracaps. Then the energy is used to propel the buses to about 10 to 15 mph, at which point the combustion engine takes over. This system manages to avoid the big puff of black smoke that everyone, China particularly, is interested in reducing.

“Because you’re driving electrically to get up to speed, you’ve managed to boost your fuel economy by double-digit percentages,” said Everett. “We’ve heard pretty amazing numbers for some systems, although we don’t always see raw data to verify it, but certainly a 15 to 20 percent fuel economy increase in a bus is a reasonable target when you think about electrically propelling this huge mass from start.

And it’s almost for free, because all the energy to charge the ultracap comes from the braking event. When batteries are used for braking energy recovery in hybrid buses, their charge acceptance isn’t great enough, so they have to mix between dumping the energy out as heat and storing it in a battery. The braking event only lasts a few seconds of very high power creation, and the battery at the low charge acceptance rates is incapable of absorbing all the energy available. The battery will take as much as it can; in contrast, the ultracap will take everything that you can give it.”

Engineeing Notes

Roundtrip efficiency

Ultracaps are extremely efficient at returning the energy put into them – 98 to 99 percent, thanks to their low internal resistance. The roundtrip efficiency of lithium-ion batteries is generally quoted in the range of 90 to 93 percent. At the system level, the efficiency of regenerative braking energy recovery is going to depend on the architecture – the electric drive, control circuits, etc.

For the most part, hybrid bus deployments occur where government subsidies exist, because of the premium that comes with the advanced technology. A standard 40-foot passenger bus costs somewhere in the neighborhood of $125,000 to $175,000, while a hybrid version costs around $350,000 to $500,000. This makes China a very attractive market for hybrid bus builders, because the People’s Republic has been spending a lot of money in recent years to clean up the air quality in urban areas.

“What cities are doing is spreading the subsidies across different technology platforms. So, in the same city you’ll see buses that contain ultracaps and buses that contain batteries,” explained Everett. “They’re really trying to determine what’s the best technology, and ultracaps are getting their fair share, without a doubt.”

Typically, the hybrid systems in buses use either batteries or ultracaps. The battery systems contain more energy, so they do more “hybrid” operations, such as running the fans in the bus to keep people cool and all the other energy-related things that ultracaps can’t do. But battery hybrid systems are also much heavier, they’re negatively affected by cold weather; and (as Everett pointed out) they’re less efficient at capturing regenerative energy. So, there is a cost-versus-benefit discussion that will likely rage on for years to come as both ultracaps and advanced batteries fight to become cheaper solutions.

But there is also very strong data to show that combining batteries and capacitors together will enable the batteries to live longer by a substantial amount.

A Battery-Ultracap Hybrid

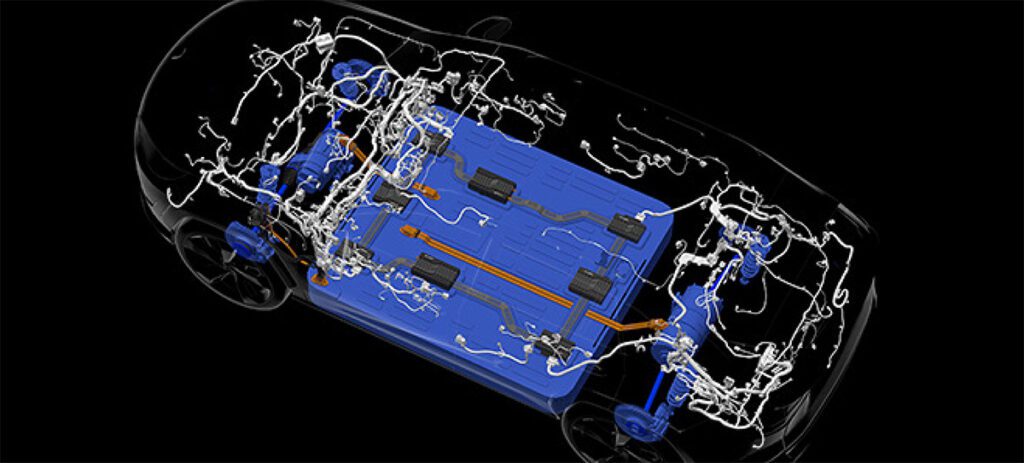

In recent years many research organizations, including Argonne National Laboratory and the National Renewable Energy Laboratory, have been discussing and demonstrating the potential benefits of combining the best of both energy storage devices. The basic idea is to build a high-energy battery pack containing ultracaps to take the edge off of peak charging/discharging events. Some have suggested that these extreme rates can be as detrimental to lithium-ion lifespan as deep discharges and repeated cycling.

So, a “hybrid” pack might be the way that ultracaps eventually find their way into EVs. The concept has yet to be proven commercially however, so the jury is out on the real benefits of a combined system. Everett told us that, in time, he thinks batteries and ultracaps will “ultimately be together.”

“Ultracaps are not designed to be energy devices, and that’s an inefficient use of their strength. They are really power devices. A 10-second burst of power – 1000 A, 10 kW or 15 kW – that’s where the real benefits come in. And every application in a vehicle requires some heavy bursts of power. Maxwell’s philosophy is let the ultracaps shine where they shine, let the batteries shine where they shine, and put the two of them together to make the best system possible. When a battery is sized for a power application, the ultracapacitors can enable a reduction in the size, weight, and cost of the battery by picking up all the power requirements and, again, allowing the battery to behave as a superior energy device.”

However, Everett explains that there is still a problem with the price point. “[Batteries and ultracaps both] need to drive the economics down. We don’t think ultracaps are inexpensive enough yet. We are constantly driving the price down, working with our suppliers and others to bring every cost advantage we can.”

Every Last Drop

Maxwell and other ultracap and battery makers have done a very good job at incremental cost reduction. They take Part A and make it for 30 percent less than they used to make it for. Then they take Part B and replace it with a different material, paying 80 percent of what it used to cost. But this approach is quickly reaching a point of diminishing returns, where there is really not much more to wring out.

So the new approach has to be one of rethinking the problem and looking for solutions that haven’t cropped up in the incremental method. Everett points to activated carbon as a good example.

“It is the active material in most ultracaps out there, and it’s pretty expensive, between $20 and $50 per kilogram. There are activated carbons you can buy for $3 per kilogram, but they have a lot of impurities.

“It is the active material in most ultracaps out there, and it’s pretty expensive, between $20 and $50 per kilogram. There are activated carbons you can buy for $3 per kilogram, but they have a lot of impurities.

They’re not exactly right, so you mitigate the performance of the device in some really major ways if you use these inexpensive carbons. But knowing that $3 per kilogram carbon exists, to me is an opportunity to figure out what can be done to it. Can we take a $3 per kilogram carbon, and turn it into a $5 per kilogram activated carbon that works well?”

“It’s the same problem battery makers have. We have to push everything from the technology, to the architecture, to the construction and packaging of the device.”

Power Potential

Like companies in the battery industry, Maxwell sees enormous potential for low-cost advanced power storage. It has only been a few years since ultracaps have been the biggest part of its business. The company also has respectable market shares in the high-voltage capacitor and microelectronics spaces. While both are strong markets, they are more mature and ultimately limited in growth potential, whereas the ultracap market is largely unconstrained, and really only a function of economics at this point.

“I think that the performance of the devices has gotten to where people have started to accept them. Yeah, there are a few things that people would like us to do to improve the performance, and sure enough we’re working towards them. But really, if we can manage to continually reduce the cost, or the price to the consumers, we will sell a lot more of them just as they are.”

Ultracap FAQs

Safety?

In the automotive world, safety is a big deal. Compared to batteries, ultracaps are easier to manage in terms of voltage stability and measuring their state of charge. It’s actually very simple with ultracaps and very complex with lithium-ion batteries.

The worst-case scenario is overcharging an ultracap. The device will build pressure until it eventually vents, leaking gas and some electrolyte. In the event of overcharging, it is dependent on the system to stop supplying current, because under continued current supply after venting, the ultracap quickly turns into a big resistor, generating more and more heat. However, unlike lithium-ion batteries, there is no threat of a thermal runaway, or self-propagating reaction that occurs from chemical interactions inside the device.

Other names?

Ultracaps are also known as: electric double-layer capacitors; electrochemical double-layer capacitors (EDLC); supercapacitors; and supercondensers.

Capacitance?

Ultracaps’ capacitance is a million times that of a conventional electrolytic device. This is primarily due to the much higher surface area made possible by an activated-carbon manufacturing process. Physical properties of the electrolyte also boost capacitance.

Emerging markets?

Ultracaps are finding their way into power and energy management solutions of all kinds, including stationary power storage, UPS systems, flash memory, portable hand tools, electric utility meters, telecom backup, and energy harvesting applications like wind and solar.