Start-ups are tough. The majority of them do not succeed, particularly those built around new technologies in burgeoning industries. Nowhere is this more evident than in the EV industry. Even with political support and government grants, many companies have miscalculated the market and the capital required to make it into the black.

In October 2012, A123 Systems, a lithium-ion battery manufacturer founded in 2001, filed for bankruptcy. The process culminated in an auction, with a number of bidders participating. The Wanxiang Group won the auction, and the sale was finalized in January of this year. For $256.6 million, the China-based automotive components company took control of the majority of A123’s assets, with the exception of its military business, which was sold separately to Navitas Systems.

A123’s struggles and bankruptcy were highly publicized, mainly because of politics – a divisive force that crept into the EV world when the Obama administration publicly threw its support behind the industry. The bankruptcy announcement came at the height of the 2012 presidential race, which only added to the scrutiny. As a result, a lot of confusion surrounded the entire process.

Almost a year later, Charged caught up with A123’s Jeff Kessen – the spokesman for the company’s automotive business – to clear up what new ownership means for the battery maker’s US operations, customers and focus.

Charged: What led to filing for bankruptcy? Was the Livonia prismatic cell recall in March 2012 the main driver?

Jeff Kessen: There was not one cause that drove A123 to its bankruptcy filing. The recall was certainly a blow, but nearly every major lithium-ion battery manufacturer has had a recall at some point in their history. It was a confluence of factors, including slower than anticipated market growth across our target applications.

Charged: What is the biggest misconception about the new A123?

Jeff Kessen: One thing that has been substantially misreported is the SEC filing where the company’s name was changed to B456. The purpose of that was to give a name to the “old A123” – the liabilities and legal matters which still had to be cleared up by the bankruptcy court after the purchase by Wanxiang.

Wanxiang also bought the marketing rights and the brand, so we’re still operating under A123 Systems. The irony is that it was intended to reduce confusion about who A123 is, and is not, going forward. But B456 created a lot of unnecessary confusion in the market.

A123 is still basically the same entity, focused on transportation and grid energy storage. The only difference is that we no longer deal with military applications.

Charged: Has leadership of the US operations changed significantly?

Jeff Kessen: At the business unit level, no. Because we’re now operated under the Wanxiang family of companies, the top senior executives are different, but essentially everyone else is still here. From the head of the automotive business to the R&D group, the company is substantially the same. We had one change in role on the management team subsequent to the sale, but that didn’t have anything to do with the new ownership.

Jeff Kessen: At the business unit level, no. Because we’re now operated under the Wanxiang family of companies, the top senior executives are different, but essentially everyone else is still here. From the head of the automotive business to the R&D group, the company is substantially the same. We had one change in role on the management team subsequent to the sale, but that didn’t have anything to do with the new ownership.

We’re actually managed by Wanxiang America in Chicago. People presume that we’re going to be moving all the technology and operations to China. There’s no doubt that we see market growth and opportunity for our technology in China, but that’s always been true. The fact is that our board resides in the Chicago area, and that’s where we’re managed from.

Wanxiang America has been in Chicago since 1993. And their typical investment approach is to buy a distressed asset in a business that they see a future in. Then, by and large, they bolster the local management team and then operate more as a holding company. Their method has been quite successful. It’s a business model that they’ve executed very well many times, and the majority of their US investments are in other automotive businesses. In 2008, the Harvard Business Review wrote a case study titled “Wanxiang Group: A Chinese Company’s Global Strategy” that detailed the successes of their approach.

Charged: What about the company’s partnerships and projects that you had underway last year – are they still in place?

Jeff Kessen: Yes. All of them, in fact. Within transportation we’re still supplying BMW for the 3 and 5 Series hybrids. We launched the Spark EV on time with GM, which just went on sale within the last month or so in California and Oregon. Our business continues with SAIC in China, and commercial vehicle customers like Smith Electric Vehicles and Daimler.

All the things that we were doing prior to bankruptcy have been maintained, with the exception of Fisker, although that is mostly governed by the financial troubles that Fisker is having. We fulfilled every order that was received and that was done before bankruptcy. They’re the only customer that I could say we haven’t produced for since the bankruptcy.

All the things that we were doing prior to bankruptcy have been maintained, with the exception of Fisker, although that is mostly governed by the financial troubles that Fisker is having. We fulfilled every order that was received and that was done before bankruptcy. They’re the only customer that I could say we haven’t produced for since the bankruptcy.

Charged: Have manufacturing operations moved?

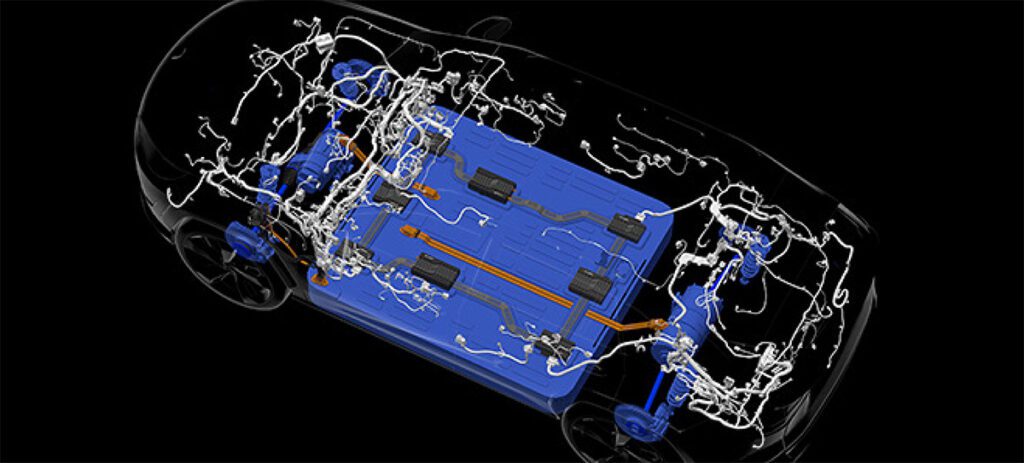

Jeff Kessen: No, the plants in Michigan are still operating. We have two facilities here, one is in Romulus and that feeds our facility in Livonia. That has been the core manufacturing footprint in the US. There’s really no substantial change. Our grid systems are still integrated and assembled in Westborough, Massachusetts. And our R&D department is also still located in the Boston area.

Charged: In May, you announced a new division called A123 Venture Technologies. What is its focus?

Jeff Kessen: It is the same R&D function that we’ve had from the beginning, and it’s mostly based in the Boston area. That’s the organization that can trace its roots all the way back to the founding of A123 and our MIT affiliation, about 12 years ago now.

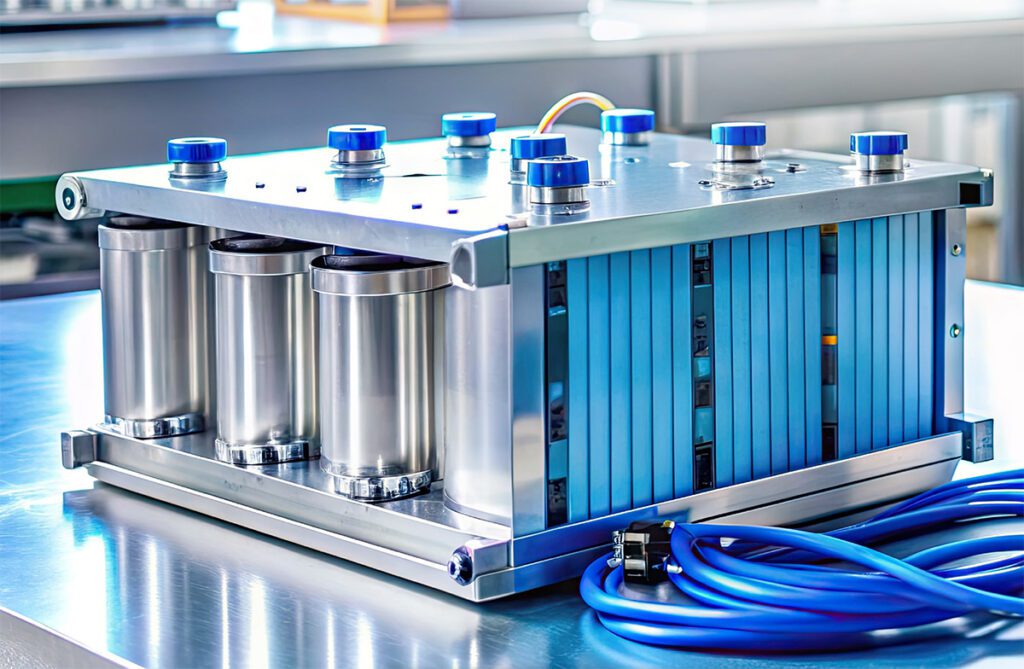

Basically, we’re offering our services and capabilities to third parties. We looked at the laboratory space we have and some of the specialized equipment that is necessary to make prototype battery cells, and recognized that our current R&D pipeline doesn’t keep all of those assets fully utilized. Having gone through the startup phase ourselves, we know there is a lot of capital investment necessary to get off the ground. So we saw the opportunity to reach out into the startup domain for batteries and offer them services to help avoid the early stage investment costs, while gaining access to various insights, like what other people are working on in the industry. It actually represents an increase in the scope of our R&D function.

Charged: What are your thoughts on the different electrified vehicle segments?

Jeff Kessen: As the market has developed and progressed, one of the better opportunities that we see – particularly for our chemistry – is in micro-hybrids. If you put four of our cells in series you get the same operating voltage range as a lead-acid battery. So we can replace it with a Li-ion battery without the need for any additional power electronics in the car. And the ability to charge our 12 V battery during regenerative braking is about ten times that of the best lead-acid.

What we’re finding is that in first generation micro-hybrids, or start-stops, engineers have really focused on reducing noise, vibration refinements and those sorts of things. And first-generation systems on any given vehicle tend not to focus so much on regen braking. But after the automaker has the basics under its belt, then the next step is often using a regenerative braking concept to make another meaningful step in fuel economy. And that’s where lead-acid technology really becomes the Achilles’ heel. We’re already finding good traction in Europe where start-stop, or micro-hybrid, systems have been commonplace for some time. But we’re also starting to see more demand from North America as well.

We have three production programs, two of which have already launched in the 12 V market, all in Europe.

Charged: In June 2012, A123 introduced Nanophosphate EXT (EXtreme Temperature), a new chemistry that is capable of operating at extreme temperatures without requiring thermal management. What is the status of its development?

Jeff Kessen: Nanophosphate EXT is something that we are really excited about, but it won’t be ready to launch into production for a couple of years. It’s not a substantial change to the materials; it’s sort of a small change in the recipe that brings big changes in the capability.

We are currently working on design validation across a broad range of operating conditions as we simultaneously prepare for manufacturing scale-up. We are currently producing small quantities of EXT cells, but the transition to full-scale production takes some time in the automotive industry.

EXT will improve performance in the 12 V market beyond what we’ve already been able to secure. It brings us better cold cranking capability, which gets us closer to a head-to-head comparison with lead-acid. And it helps us with life as well.

After some studies that we did about a year ago, it’s not clear that we’ll be able to fully eliminate a thermal management system from a high-voltage pack. There are some costs that we’ll be able to avoid by using EXT for high voltage, but I think that the cold crank benefit in low voltage is where it’s likely to be more meaningful to the market.

This article originally appeared in Charged Issue 10 – OCT 2013