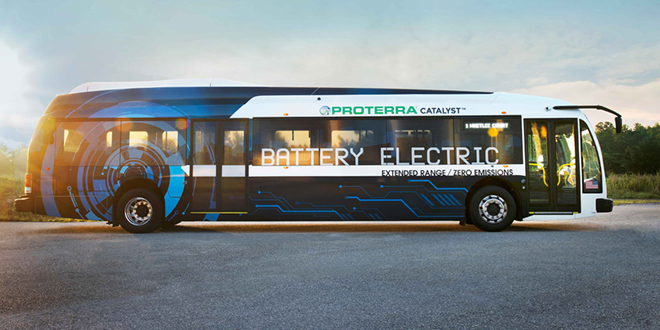

Electric transit buses enter the fast-follower market stage as the leaders work to remove the last barriers to adoption. Q&A with Proterra’s Ryan Popple and ABB’s Daan Nap on the state of the market and charging standards in North America and Europe.

With each passing year, more decision makers are realizing that city buses are an ideal application for EVs. They drive predictable routes. They can easily be charged overnight in depots or at scheduled stops during the day. They constantly stop and go, which is ideal for EV drivetrains and regenerative braking. And the prospect of eliminating the noise and the clouds of black soot associated with legacy diesel buses is attractive to both riders and city planners. Best of all, e-buses save money. Lots and lots of money, thanks to lower fuel and maintenance costs. We’re talking about hundreds of thousands of dollars over the lifespan of just one electric bus compared to diesel.

So it’s no wonder that companies in the electric bus market are very optimistic. From North America to Europe to China, the industry continues to mature quickly, and leaders are beginning to emerge, with strong business models.

Charged recently caught up with a couple of those leaders to talk about the current state of the electric bus market, and learn more about developing charging standards around the world.

Proterra is a clear leader on our home continent. The company claims over 50% market share in North America in terms of both customers and vehicle count. We asked CEO Ryan Popple where the EV transit industry is headed in the next few years.

Charged: In 2015, you told us that Proterra’s sales pipeline opportunities grew about five to seven times compared to the previous year. Has the fast growth in customer interest continued?

Ryan Popple: Yes, it continues to grow at a pretty impressive clip. Last year we were planning on delivering roughly 1% of new transit vehicles to the US market, and we’ll hit that metric this year.

What’s changed is that now we’re more capacity-constrained than demand-constrained. For 2017, we’re going to triple capacity over 2016. We’ll be shipping between 100 and 150 buses next year, and we already have all of those orders on hand. We used to try to run the business with a six-month order backlog. Now we’re at about 18 months of backlog, and we’re selectively making capital investments in our supply chain so we can bring the backlog back down. If we don’t ramp even faster, the next order we take will be for early 2018 delivery.

I spend a lot of time right now figuring out how to de-risk our growth rate. That means working really closely with a few key suppliers to make sure they can ramp, and also buying ahead on key pieces of inventory. We’ve realized that we won’t be accomplishing our mission if we get customers excited about EVs and then tell them they can’t get vehicles until 2018 or 2019. So the focus has shifted over to supply.

I’ve worked with a lot of tech companies in my career, and usually around the summer is when they inform the board of directors that the growth forecast is going to be a little lower than what was predicted in January. But we’ll be telling our board that we’re going to beat our forecast significantly this year, and our updated forecast will be higher than planned.

Charged: What’s the state of EV awareness among city officials and transit authorities?

Ryan Popple: On the transit demand side, I’d say it’s become an emerging practice to look seriously at EVs when placing an order for new buses. It’s not quite a best practice yet, but an emerging practice is still very powerful. At all of the transit conferences, there are now multiple panels and a lot of experts talking about EVs.

We’ve also seen the first public transit agencies in the country starting to pass board-level resolutions to mandate that their fleets will go to 100% electric in a certain amount of time, which is a very powerful example for other agencies.

From an economics perspective, we’re running the table on natural gas and diesel hybrid. We’ve also found ways for banks to finance the vehicles and deliver great rates of return on investing in EVs to replace diesels.

So, like most industrial markets, it starts with a flat adoption period with only a couple of early adopters, then fast followers, and then full-blown mainstream acceptance. Right now, we’re seeing a tremendous fast-follower stage for electric buses.

Charged: We saw that SEPTA in Philadelphia recently gave Proterra its largest order to date, for 25 electric buses, which sounded great. However, about a week later we saw that they also ordered 525 diesel hybrids from another company, which added some discouraging perspective. When will the EV market reach that level of order sizes?

Popple: Well, we’re already seeing some transit authorities, both smaller and larger than SEPTA, putting together implementation plans on how to replace all buses with EVs. So it will happen.

But at this stage there is really no way to skip the pilot orders and trial periods for electrification – not until the electric adoption rate gets closer to around 20% of the fleets. At that point you’re not going to get fired for buying a lot of EVs when all of your sister agencies already have them, and they work well and save a lot of money. Frankly, I think that is why SEPTA’s first order was 25 instead of 5, because they see it’s already working in other cities. That was the single largest EV order for the North American transit industry. Those aren’t options, that’s a single cash order.

I think that if we had done this pilot order with SEPTA two years ago, even if they started with 5 units at that time, then they wouldn’t be forced to make that large of a commitment to buy diesel hybrids. But no one is going to take the risk on hundreds of EVs until they’ve done a significant pilot. And soon we’ll be announcing the start of pilots with other large northeast agencies, which is great – it needs to happen.

I also predict that, for a lot of these huge orders you see for 500 or 800 diesel buses that include long-term options to buy more, those options are not going to get exercised. They’ll probably ship the first third of that order, and then the transit authority board, the city’s mayor, or even the transit staff are going to insist that they don’t exercise the remainder of the options of the contract. This is because the backlash against fossil fuel is really building from an economic perspective. As you run the numbers on how much money they’re going to waste by deploying 500 diesel hybrids instead of EVs, you’re going to have taxpayer watchdogs start to come out of the woodwork and say, “This is crazy!” The reason it’s still happening is because EV tech is still relatively young and we have to prove it out. So we’re currently proving that we’re not equal to diesel, we’re better.

There will also be environmental and social justice pressures. How do you deploy 25 zero-emission buses in one part of the city, and then continue to emit diesel fumes on all the other bus routes? There is a fairness aspect to that. I think that, in time, the neighborhood that is next to the one with EVs will ask, “When are you going to stop making me breathe diesel exhaust? If it’s cheaper to run EVs in the city, when are we going to get them in my neighborhood?”

That’s why we’re starting to see those roadmaps to go all-electric from transit agencies. They want to communicate the plan to the communities that are asking these questions.

Charged: What about from a production point of view? When will Proterra and the rest of the electric bus industry be able to support orders for hundreds of buses?

Popple: At Proterra, we’re building this business long-term to be able to annually provide thousands of buses to customers in North America.

So, in addition to our South Carolina manufacturing site, we recently opened a west coast factory in California. We’re thinking about it in terms of modules of growth. We’re at about 50 vehicles per year now. Next year we’ll finish at a run rate of 200, a year after that 300, then 500, and so on.

We think we are leading the industry in terms of product efficiency and performance because we’re solely focused on EVs, and have designed our buses from the ground up to be electric. Our customers know that, which is why we have well over 50% market share in the US in terms of vehicle and customer count. So now they want to see our scale plans. They want to know that when they give us an order for 100, 200, or 500 buses, we will be able to deliver it.

This is very similar to what we went through at Tesla going from Roadster to Model S [Popple was an early employee of Tesla Motors, where he served as Senior Director of Finance]. No one in the traditional auto industry thought they needed to worry about Tesla taking real market share. Then they woke up one day and Tesla was shipping 50,000-plus Model S vehicles a year. In the top 25 car-buying markets in the US, Tesla was beating Audi, Mercedes, BMW and other cars in the same price range. And exporting them to Germany. No American car gets exported to Germany. They’re proud of their technology. You don’t see Mustangs driving around in Munich, but you do see the Model S.

We think a similar thing is going to happen in the bus market. We want to get to thousands of units per year, and we know what that cookbook looks like. Over the next five to ten years that ripple effect is going to happen.

Charged: In June, Proterra announced that it was opening its overhead fast-charging technology to the transit industry on a royalty-free basis. What led to that decision?

Popple: It’s really about removing the last barriers to adoption. Some transit customers have expressed concerns about vendor lock-in, because we use a proprietary overhead charging system. And there are currently no North American standards for electric bus charging.

Last year one customer told us that, while they really liked our buses, they had been slowed down in implementing more EVs because a diesel bus manufacturer told them that if they chose EVs, they’d be forced to buy only Proterra vehicles in the future. So we had to find a way to remove that concern.

Image courtesy of SounderBruce (CC BY-SA 2.0)

Image courtesy of SounderBruce (CC BY-SA 2.0)

That customer got us thinking more broadly about the industry. What everyone really needs is an open standard that is a proven and safe solution. So we want to step out from controlling the infrastructure and just focus on building vehicles as fast as we can.

As the pioneer in North America, we had to come up with our own charging solution because there was really nothing off the shelf to buy. But a healthy market means competition, and we want to see more EVs from other companies. By officially sharing the technology, we want to reassure customers that we’re not interested in building a business by locking people into a hard network effect. We’re actually totally fine with the idea of them deploying competing EVs in the future that use the same charging hardware. We look forward to the opportunity to win a lot of market share by building the best vehicles.

Image courtesy of SounderBruce (CC BY-SA 2.0)

Image courtesy of SounderBruce (CC BY-SA 2.0)

Also, we didn’t want other bus companies to have to buy the technology from us. This will allow us to get multiple vendors to be able to provide these chargers. Someone could start a new company based on building the equipment, or they could teach a vendor how to build it. As long as they use it safely, we don’t care.

In the future, we want to have large competitive EV RFPs. So this is about market evolution, and the decision we had to make to enable electric buses to be a truly large market.

Charged: We’ve seen a lot of news recently about pilots that wirelessly charge buses at stops along the route. For example, WAVE, which we wrote about in our March/April 2016 issue, believes that wireless charging is the best way to go. Does Proterra offer wireless options to your customers?

Popple: No, not currently, but we keep our eye on wireless very closely. We have looked at a lot of wireless systems, but when we dug into them, we realized the technology wasn’t as far along as we’d hoped, and the proven charging levels aren’t high enough to perform useful work in transit applications.

There’s a lot of good stuff about wireless from a conceptual level, but our responsibility as a company is to advance EV tech as quickly as possible. If a system is safe, high-power, cost-effective and reliable, then we’ll put it into our portfolio. But we’ve yet to see that in the wireless market.

We set the power transfer bar really high with conductive charging. We charge at higher power levels than anyone else in the EV space – three times higher power than Tesla superchargers, about eight times higher than CHAdeMO. And we do it in all weather, with passengers on the bus.

The technology areas where I’m not optimistic are hydrogen fuel cells and battery swapping. For transit, I think they’re a waste of time – they don’t make sense economically, given how BEV has advanced (I could go on and on about why that is). But I wouldn’t say that about wireless – it just needs more testing and product development to be ready for wide adoption.

Charged: In Europe, electric bus manufacturers and charging system suppliers have agreed to work together on developing an open charging interface standard. Are there any similar efforts in North America?

Popple: There is an early effort underway to work on a standard, and we believe that the starting point for that kind of conversation is for companies like Proterra to open up their technology to allow others to work with it. We have over a quarter million high-power overhead charge events, so we’re pretty confident in the system. And honestly, we think that our overhead charger technology is much better than the pantograph-style chargers that those in the European consortium are still piloting.

Our experience experimenting with different fast-charging systems goes back further than most EV companies anywhere in the world. We’ve tried many different systems, and we’re confident that the patented, single-blade overhead charging design that we decided to open to the industry is the most reliable and safest.

The biggest thing that we learned, working in all-weather environments, is the importance of having fully enclosed high-voltage connections. Our system has an insulated enclosed cap on the charge head that comes down, and the blade on the bus is also insulated. It has very robust metallic plugs that are activated and inject into the socket. It works in the snow and rain. For cold-weather customers there is a de-icing capability – the blade can warm itself up. And the ergonomics of the charge head will actually plow the snow off the top of the bus.

We also think our system is superior in terms of the sophistication of its user interface. As far as I know, we’re the only company in commercial operation that uses autonomous drive technology to dock the vehicle. After 2.5 million EV miles, we’ve learned that you need to use software technology if you’re going to align the bus with the charger perfectly every time. Once the bus is within range of the overhead system, an identification process occurs and the velocity of the bus is controlled all the way down to the stop. The driver remains in full control of the steering and has the ability to stop the vehicle, but we wanted to prevent the driver from going into the charge station too fast or passing the charge point. It’s very dangerous to back up a bus. If you miss the location, you probably have to go around the block. And in cities, that can be a disaster for the schedule.

Our philosophy is that anytime we see a standard that already exists, we’re going to use it. I’m optimistic that other truck and bus companies that are starting to experiment with EVs will follow our lead in adopting CCS for plugging in the bus. But there are some companies that are trying to create a separate plug standard for buses and trucks, and I think that’s going to fragment the market. We really should be doing the same thing, and building upon what the auto segment is doing as much as possible.

European cooperation

In March 2016, a large group of bus manufacturers and charging infrastructure providers announced that they have agreed to develop voluntary charging standards. The objective is to ensure reliability and compatibility across all bus brands and charging systems, as the number of European cities running EV trials continues to grow quickly.

The European body CEN-CENELEC and the international standards organization ISO/IEC are currently working on charging standards, which are expected to take effect in 2019. However, with many cities already launching large EV deployments, the market leaders have an increased sense of urgency to meet the concerns of their customers. The consortium members include European bus manufacturers Irizar, Solaris, VDL and Volvo, together with charging system suppliers ABB, Heliox and Siemens.

Charged recently talked to Daan Nap, ABB’s Global Sales Director for Electric Bus Charging, about the transit market and the standard conversations taking place among the group. The company is one of the world’s preeminent EV charging leaders, and has supplied over 4,000 of its DC fast-charging solutions globally. As a result, ABB works with most electric car, bus and truck makers worldwide – giving it a great perspective on market trends.

Charged: How is the general market for electric buses in Europe, compared to North America?

Daan Nap: There is a little bit more momentum in Europe, but I see the US picking up very quickly now as well. I think in the future they will develop side by side.

Many major European cities are now saying they will buy only electric buses only as of 2020, 2025, or 2030. So the existing fleet will phase out in the coming period, and all city buses will go electric. The cycle life for diesel bus replacement is typically 8-10 years. So I expect that in two to three cycles – about 16-20 years – the vast majority of the market for new vehicles, 80 or 90%, can be fully electric. And that is huge in such a short time frame.

This will bring up the innovator’s dilemma. In the same way we could see a newcomer like Tesla get very big, very quickly. Today’s leading car and bus makers have a good position on the internal combustion engine technology. They are now facing the trend of vehicle electrification, which is a sort of disruptive technology. So I think there will also be newcomers that will step out and say, “We don’t have a lot to lose, so we’ll go full blast on electric.” We see this happening already.

In Europe there are a few big bus makers with multiple smaller players. I think Volvo was one of the first global players to realize that electric buses are going to happen anyway, and they have stepped up to become a leader in this field.

In China, there are a lot more electric buses than in the US and Europe [some sources say there are already over 100,000]. I predict that we’ll see more Chinese companies beginning to export more, like BYD who have the benefit of volume on their internal market. So I think these developments can change the player map in the coming period.

Charged: So what exactly has the European cooperation for bus charging agreed to do?

Nap: First of all, everyone agreed that it would be very confusing for the market if companies decided to do charging in different ways. Customers will be hesitant to adopt because they’re afraid to buy the wrong system. So we decided to sit down and try to find the things we do agree on.

Everyone agreed that if you’re in a depot and you’re charging overnight, then charging will be DC (Direct Current), using the same combo plug used for passenger cars – this is the CCS Type 2 connector in Europe and will be CCS type 1 in the US. As for the power level, we agreed that may vary based on the use case of the customer and normally will be somewhere between 20 and 150 kW, which can be supported with the CCS standard.

The second issue that everyone agreed on is that we need to have common opportunity charging interfaces as well. However, there were different ideas about how overhead charging is best implemented. Some prefer a pantograph system that is mounted on the bus and raises up to make contact with the overhead charging unit. Others prefer the opposite – an inverted pantograph system, where the pantograph is mounted on the infrastructure that comes down to the bus.

So at this point, everyone has agreed to support a common interface for the inverted pantograph system, and part of the group also support the system where the pantograph is on the bus as well.

Charged: Which open interface will ABB support for opportunity charging?

Nap: At ABB EV Charging, we’ll focus solely on the inverted pantograph infrastructure, which is also referred to as OppCharge. We think it’s the most cost-effective solution when going into volume. The pantograph hardware costs money, and you always have more buses then charging infrastructure. Many bus manufacturers agree, and would like as little weight, complexity and costly systems on the vehicle as possible.

Charged: Do you have any specifications for the standards?

Nap: One goal is to reuse and comply with everything that is already in the Combo spec for passenger cars. The main changes we have to make are that buses are higher voltage – instead of 300 to 500 V we need to go higher, 400 to 850 V. And instead of 50 kW, we will go as high as 300 or 450 kW and even up to 600 kW. Also, for the opportunity charging using a pantograph, we’re further developing the wireless communication protocols in the CCS standard to enable communication between a pantograph charger and a bus when it arrives at a station.

These topics are being worked out at the moment among this group and also in other initiatives together with the more formal standardization bodies like UITP and CEN-CENELEC. So the challenge is to make sure they all cooperate and it’s done in a very effective and safe way. It’s important that in the end we have a totally open and independent system, where buses and chargers are interoperable. Then any transport authority can buy buses from brand A, B, or C, and then any brand of charging infrastructure to work with it and vice versa. We see that customers are keen to prevent vendor lock-in. They are asking for open standards that ensure interoperability between the various brands. So that’s the goal to enable the market.

Charged: Do you think the US will adopt similar standards?

Nap: Yes, I think eventually there will be consensus about reusing the CCS plug standard as much as possible and then converging onto a shared overhead charging pantograph specification. Soon we’ll be announcing some interesting projects in the US as well.

Opting out of overhead charging

While many of the world’s electric bus makers are working hard on overhead charging systems and standards, there are some that think it makes more sense to skip it all together. For example BYD – one of the world’s most established electric bus builders, now with over 10,000 battery-powered buses on the road – doesn’t offer any overhead charging system to its customers.

“We think the cost outweighs the practicality,” Ted Dowling, BYD’s VP for Canada & Pacific Northwest, told Charged. “There’s no reason to use it when you can get the range out of the vehicle that we already do. BYD builds a range of buses capable of servicing routes up to 200 miles in length in their final year of service [according to the US DOT standard, which is 12 years]. That meets 85% of the route structures and provides a solution that results in little to no adaptation whatsoever. BYD has made it a top priority to provide a product that does not interfere with business as usual.”

“It’s much simpler to design the buses for the routes than to do massive alterations for infrastructure overhauls,” added Matt Jurjevich, BYD’s Director of Business Development in Canada. “We wanted to offer a solution to transit operators so that they would have to change as little as possible in their process. Our vehicle electrification strategy is based around helping cities become more efficient, and this goes beyond just the environmental and economic impacts.”

BYD buses use a plug-in charging system with power levels up to 350 kW that it says is capable of recharging a bus in about three hours. “To us that’s the most manageable solution,” said Jurjevich.

The Chinese company has been selling electric buses in North America since 2013, when Stanford University deployed 13 of its EVs. BYD reports explosive growth similar to that of other companies we’ve spoken to. It recently delivered its 10,000th bus worldwide, and already has over 7,000 orders this year. “In North America, we now have close to 300 orders (including long-term options), which is a massive jump in our market share over last year,” said Dowling.

This article originally appeared in Charged Issue 26 – July/August 2016. – Subscribe now.