Sales of EVs and PHEVs are growing at what seems like an impressive pace, but are still tiny in relation to the larger auto market. Total new vehicle sales reached an all-time high of over 17 million in 2015, but plug-in sales just cracked the one-percent mark in Europe, and are still well under one percent in the US.

Theories abound as to the reasons for the tepid growth rate, but it’s increasingly obvious that independent dealers are one major bottleneck. Several EV media outlets have sent “secret shoppers” to auto dealerships, and they have found that most dealers are shockingly ignorant about how EVs work, and that some actively discourage customers from buying them. A 2014 study by the Institute of Transportation Studies at the University of California, Davis reached the same conclusion. Charged devoted an article to the dealership dilemma in our June/July 2014 issue.

The topic crossed over to the mainstream media in December 2015, when a feature article in the New York Times reported that dealers “are showing little enthusiasm for putting consumers into electric cars,” and cited several examples of would-be EV buyers being steered to legacy gas vehicles.

However, not all auto dealers are stuck in the 20th century. Heath Carney, Electric Vehicle/Sustainability Manager, and John Sullivan, Dealer Principal at the Sullivan Chevrolet/Auto Group in Roseville, California, contributed the following article to Charged.

A dealership perspective

All of us who support EVs, including OEMs, government entities, utilities, EVSE businesses and journalists, need to target and overcome the key obstacles to greater adoption by mainstream auto buyers.

The emphasis on technological problems by the media has been holding back some consumers. However, the technology that meets the needs of most commuters arrived with the introduction of the Chevrolet Volt and Nissan LEAF. The Tesla Model S then provided even more electric range for longer trips. The Model S and Volt have received the highest ratings from Consumer Reports and many other sources.

The key obstacles to greater adoption are social rather than technological, specifically in the distribution, marketing, and sales of EVs. In this article, we focus on the location where the mainstream consumer makes the decision to buy an EV or a conventional vehicle: the dealership. We propose several key changes that could take us from thousands of EV sales to millions. Our recommendations are based on both personal interactions with thousands of customers and quantitative information for the key market of northern California and the US as a whole.

The conventional wisdom is that the dealership is the weak link, due to poor attitude and training of salespeople. However, the best dealerships can make EV sales easy and convenient for even the most challenging customers. Dealerships can be transformed from weak links to vital regional resources for clean and reliable transportation. They can become more respected members of their communities by linking EVs to local renewable energy sources and charging infrastructure.

The keys to this include better understanding of EV technologies (especially the differences among BEVs, PHEVs and conventional hybrids), better EV availability and selection, and more streamlined sales processes and incentives.

Many consumers are put off by articles in the media that have poor or outdated information about EV technologies. Even some of the more positive press often gives the impression that improvements in EVs (especially battery technology) are still needed. Worse, several recent articles in reputable magazines include misinformation, and give a very negative impression of EVs other than the Tesla Model S. While EV drivers quickly realize how inaccurate they are, most mainstream consumers will assume this information is correct. When they come into the dealership, they have so many questions and concerns that they are not ready to buy.

Dealers and other stakeholders need to facilitate rather than complicate the following key elements:

Sufficient and sustained inventory and selection

While this seems like an obvious point, this condition has rarely been met since EVs began to appear in late 2010. Many dealerships received only one or a few vehicles. Sales remained modest because there was not enough selection (customers want a choice of colors and options such as cloth and leather seats). At our dealerships, we have found that we need at least 10 Volts for sufficient selection, and we should have at least 20-30 during periods of peak demand.

Another need is to have sustained supply that keeps pace with demand and sales. At our dealerships and others, many EV models have been sold out for months at a time, which can mean sales lost to gas vehicles. It can take weeks or months to regain sales momentum when more new EVs finally arrive.

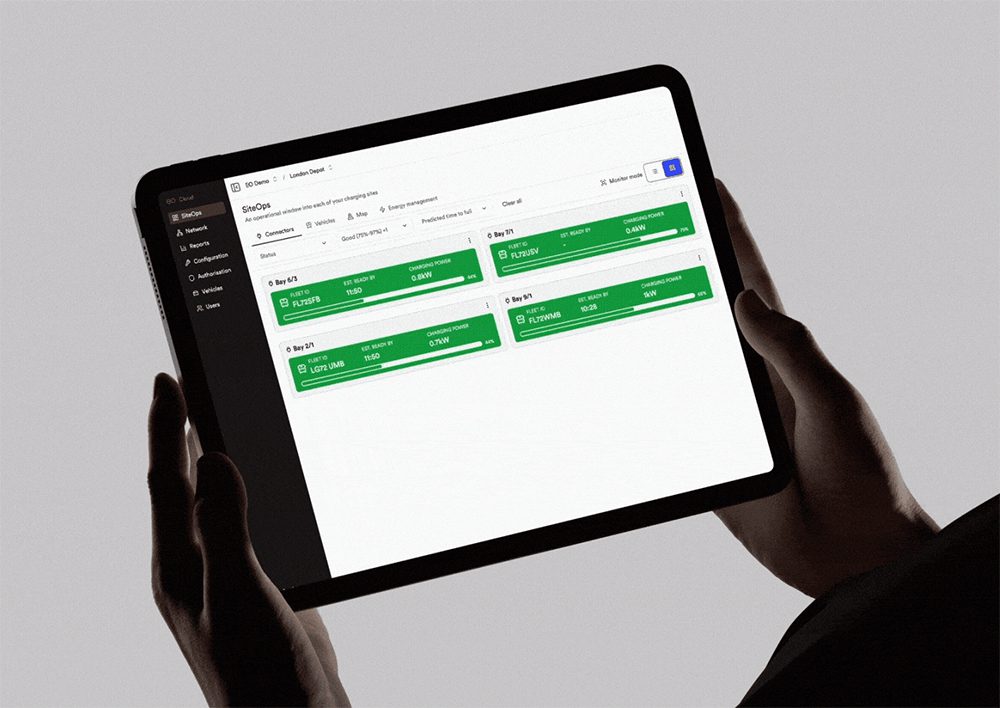

EV-friendly displays and supporting facilities

We have found that having EVs displayed under a solar canopy with charging stations greatly increases customer interest. The solar canopy generates discussions about customers’ solar systems at home and/or work. We have several major brands of chargers (ClipperCreek, Bosch and ChargePoint) so customers can decide which they prefer. Finally, we have brochures about regional utility and charging information on the showroom floor. All of this demonstrates that we have the resources and interest to serve EV customers.

This also applies to a dealership’s web site. We have developed a web page that includes inventory, model information, and links to information about incentives, utilities, charging and mobile apps. The goal for any dealership should be to include the most relevant information for customers in their market region. This web page is used daily at our dealership, but we have not seen anything like this at other locations.

Trained and motivated staff

The main concern reported by EV customers is that salespeople do not understand or want to sell EV models. Manufacturers have training launches and materials that focus on specific models, but more is needed. We have started a sales and service training program at our dealerships that has improved understanding and motivation, and this has contributed to more sales and better service. This can be accomplished with just a few hours of training in the areas of EV technologies (types of BEVs and PHEVs), charging (levels and locations), and incentives (federal, state and other). We have combined OEM training materials with relevant information for our marketing region, with the support of the California Employment Training Panel.

To maintain training and motivation, there needs to be sufficient inventory and sales activity. A salesperson selling just one EV or less per month may not keep updated on features and incentives, so there should always be at least one EV specialist per dealership.

Finally, an EV sale can take longer, because of the need to explain new technology features and incentives, and salespeople should receive adequate pay for this. Dealerships should consider offering additional compensation for EV salespeople. Many EV sales need additional hours of education, demonstration and follow-up, so more pay per sale will greatly improve motivation.

Incentives that are easy and immediate

While incentives can clearly help, they can also slow the process and sometimes even stop the sale. One recent example was an offer of a very limited number of free AeroVironment chargers for new BEV customers which were available just at the beginning of each month. Customers (and dealerships) had to wait until the right time period, and then they lost interest when the limited supplies ran out.

Incentives can also lower customer satisfaction when there are long delays in getting them. Examples of this are the California state rebates and green HOV stickers. When supplies ran out, new EV owners were put on waiting lists. Dealerships can’t do anything about these situations, but questions and complaints are still directed to dealership personnel.

The most effective incentives are those that are applied the date of the sale to reduce the price. Most manufacturer incentives are structured this way, but federal, state and regional incentives are generally less immediate. Unfortunately, the $7,500 federal tax credit can be subject to a long delay, and many consumers do not qualify at all, as they do not have this tax liability at the end of the year. This is especially relevant for most mainstream buyers, who pay taxes with every paycheck. The federal incentive would be significantly more effective if it were available at the time of purchase, regardless of income or tax liability. We have been able to incorporate the federal incentive at the point of sale in certain leases (as part of the Capitalized Cost Reduction, when allowed by the financing bank) to retail customers, and some purchases by public fleets. This clearly helped all these EV sales.

In September 2015, Connecticut provided a positive example, announcing a new incentive program called CHEAPR, which offers consumers $750 to $3,000 in “cash on the hood” instead of a tax rebate. Better yet, car dealers get to keep $150 to $300 of each rebate, in order to motivate salespeople to promote plug-ins.

Coordinated support for new EV owners

New EV owners face a learning curve of up to one month after the initial purchase, which includes getting adjusted to home charging. So it is critical for dealerships and other parties, including utilities, to coordinate their efforts. Customer satisfaction surveys sent just one to two weeks after the sale may arrive during this period of adjustment, and before incentives are completed. While there can be questions and concerns during this period, we have found that, if these are addressed, EV buyers can be the happiest of owners.

Stronger connections among community stakeholders

Major economic stakeholders include OEMs, dealers, utilities, charging network operators, EVSE manufacturers, electricians, and clean energy providers (solar and wind). Community stakeholders include cities, counties, air and environmental quality districts and public health groups. The dealership can be the key location that coordinates opportunities and partnerships for all of these stakeholders at the local and regional levels. For example, we have developed strong business relationships at our dealerships with charging companies (Clipper Creek, Bosch, ChargePoint, Plugless and others), electrical installers (Phil Haupt Electric), and utilities (SMUD, Roseville Electric, and PG&E).

Convenient charging infrastructure

For the most part, charging infrastructure is outside of the purview of dealerships. However, the impact of infrastructure on EV sales is enormous, and it’s important to highlight that fact whenever possible. Some studies have indicated (and we can confirm) that those with access to workplace charging are many times more likely to buy plug-in vehicles. Many customers cite convenient charging as a key reason for purchasing an EV. At the same time, unreliable public charging is a major concern for potential customers, and a real-world problem for some EV drivers. We’ve fielded our share of calls from customers having trouble with public charging stations.

EV sales are still being held back by poor public perception and a lack of adjustment to the special opportunities and needs of EV sales. We will overcome these obstacles if we can work together to provide the necessary resources, and streamline the sales and ownership experiences. If we can make the dealership a place where the consumer can directly compare and experience the benefits of EV technologies, then we can finally jump from thousands to millions of EVs on the road.

This article originally appeared in Charged Issue 24 – March/April 2016. Subscribe now.