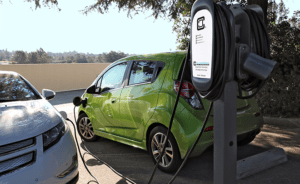

Green initiatives are on the chopping block in Washington these days, but two of the most important federal incentives have escaped the axe for now. After a bit of back-and-forth, the federal tax credit for plug-in car purchases survived in the final version of the Republicans’ tax cut bill. Now Congress has added a few… Read more »

Search Results Found For: "tax credit"

EV industry fights congressional plans to abolish federal EV tax credit

The latest salvo in the US government’s war on technology is contained in a House bill with the Orwellian title of the Tax Cuts and Jobs Act, which would eliminate the federal tax credit for EV purchases. There’s good reason to believe that killing the tax credit could cripple America’s nascent EV industry. In Denmark,… Read more »

Colorado sweetens EV tax credit

As auto dealer Heath Carney wrote in the March/April 2016 issue of Charged, EV purchase incentives might be more effective if buyers received them in cash at the point of sale, rather than having to claim them later as tax credits. Connecticut instituted such a program in 2015. Now the state of Colorado has acted… Read more »

Will federal tax credits still be around by the time you get your Model 3?

(Updated 4/5/16 11:00am EST to include link to IRS code and information suggesting how Tesla could maximize available tax credits.) Tesla’s mission has always been to bring EVs to the mass market, and the culmination of the company’s grand strategy is the Model 3, unveiled last week at a price of $35,000. Auto market analysts tell… Read more »

Study: EV tax credits go mostly to high-income households

A new study from the Energy Institute at Haas, University of California, Berkeley, has reached an unsurprising conclusion: the benefits of federal tax credits tend to go mostly to higher-income households. Researchers Severin Borenstein and Lucas Davis found that 60% of the $18 billion in US federal clean energy tax credits issued between 2006 and… Read more »

Georgia reverses policy on EVs, eliminating tax credit and imposing yearly fee

As expected, last week Georgia’s legislature passed a highway funding bill that not only eliminates the state’s $5,000 tax credit for EV purchases (effective July 1), but imposes a yearly user fee – $200 for personal vehicles and $300 for commercial EVs. Other states have introduced, or are considering, fees for EV drivers, but Georgia’s… Read more »

Georgia Senate votes to eliminate tax credit and impose yearly registration fee on EVs

It’s not looking good for Georgia’s EV tax credit. The Georgia Senate has passed a transportation funding bill that would eliminate the state’s $5,000 tax credit for leases and purchases of EVs. In fact, the bill imposes a yearly registration fee on EVs: $200 a year for personal vehicles and $300 a year for commercial… Read more »

Georgia’s EV tax credit on the chopping block

Chuck Martin, a Republican Georgia state representative has introduced a bill that would put an end to Georgia’s $5,000 state tax credit for EV purchases, which has been credited with making Atlanta the #2 market for plug-ins in the country. “Is it really good state policy to pay $50 million per year to let a select… Read more »

What happens when the EV tax credit is phased out? (Don’t ask the IRS.)

How important is the $7,500 federal tax credit for EV buyers, and what will happen to the market when it is eventually phased out? Vehicles from a particular automaker are eligible for the tax credit until it has sold 200,000 EVs in the US. After that, buyers of the company’s vehicles will get 50 percent… Read more »

Bill would pull the plug on Georgia’s EV tax credit

Georgia legislators can’t seem to make up their minds about EVs. Just days after a trio of Republican state legislators introduced a bill that would let Tesla sell up to 1,500 vehicles a year directly to consumers, one of those same lawmakers, Chuck Martin (R-Alpharetta), has proposed to eliminate the state’s $5,000 tax credit for… Read more »