Battery materials and technology company NOVONIX has been selected to receive a $103-million tax credit under section 48C of the Qualifying Advanced Energy Project Allocation Program, to support production of critical battery materials at its Riverside facility in Chattanooga, Tennessee. The 48C tax credit is designed to incentivize clean energy property manufacturing, industrial decarbonization, and… Read more »

Search Results Found For: "tax credit"

Is it true that only 13 EVs currently qualify for a US tax credit?

Sometimes public policy gets skewered on the horns of a dilemma. The Buy American provisions of the Inflation Reduction Act are aimed at protecting US jobs (and national security) by making EVs with substantial amounts of battery components from “nations of concern”—namely China—ineligible for tax credits. That’s a worthy goal, but to a certain extent… Read more »

White House clarifies (sort of) EV tax credit eligibility rules for foreign companies

The Buy American provisions of the Inflation Reduction Act and Bipartisan Infrastructure Law have been the topic of much speculation and more than a little controversy. Now the Biden Administration has issued a set of rules for determining which foreign entities of concern (FEOC) are not eligible for EV-related tax credits and other subsidies. The… Read more »

Pyka receives $7-million California tax credit to expand zero-emission autonomous aircraft manufacturing

Electric aircraft startup Pyka has been awarded a $7-million California Competes Tax Credit from the California Governor’s Office of Business and Economic Development (GO-Biz)—an income tax credit for businesses that locate or grow in California. Pyka’s technology includes autonomous flight control software, flight computers, high-energy-density batteries, advanced electric propulsion systems and carbon-composite airframes. The company… Read more »

This provision of the IRA could deliver much bigger results than the EV tax credits

The so-called Inflation Reduction Act includes a long list of measures intended to promote e-mobility and renewable energy. The one that’s gotten the most press is the revamped system of tax credits for EV purchases—and naturally so, because that’s the measure that most drivers can see benefitting them directly. However, as John Voelcker writes in… Read more »

IRS releases more details about new tax credits: some foreign-assembled EVs may be eligible

We’re pleased that our pols revamped the federal EV tax credit—the new deal fixed some of the problems with the old rules, and added incentives to encourage the development of a North American supply chain for EVs and batteries. However, as is the case with any new government program, passing the law was just one… Read more »

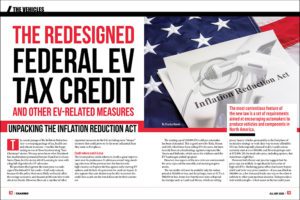

The redesigned federal EV tax credit and other EV-related measures

Unpacking the Inflation Reduction Act The recent passage of the Inflation Reduction Act—a sweeping package of tax, health care and climate measures—was like the happy ending to one of those heartwarming “Save Christmas” stories. We may never know what Machiavellian machinations persuaded Senator Manchin to release Santa Claus, but the merry old elf is coming… Read more »

Plug In America digs deep into the details of the new federal EV tax credit

The revamped federal EV tax credit is the most-discussed part of the Inflation Reduction Act, and there’s plenty to talk about. Like most government programs, it is complex, and like many, it aims to advance more than one goal. The main objective is of course to boost EV adoption from the demand side by making… Read more »

Will the Buy American provisions of the revamped EV tax credit do more harm than good?

Auto industry experts (and others) are beginning to assess the details of the redesigned federal EV tax credit program contained in the Inflation Reduction Act. There’s broad agreement that the changes will help to speed EV adoption, but there’s also concern that some provisions of the law could be counter-productive, at least in the short… Read more »

News flash: EV buyers prefer rebates to tax credits

A new survey has confirmed something that Charged and other EV media have been saying for years: the US federal EV tax credit is about as inefficient a way to encourage EV adoption as could be imagined. Providing a “cash on the hood” rebate instead could have resulted in more EV sales at a lower… Read more »