The government of the state of California plans to provide rebates to residents who purchase electric vehicles if the next US administration ends the $7,500 federal EV tax credit. “We will intervene if the administration eliminates the federal tax credit, doubling down on our commitment to clean air and green jobs in California,” said Governor… Read more »

Search Results Found For: "ev tax credit"

White House clarifies (sort of) EV tax credit eligibility rules for foreign companies

The Buy American provisions of the Inflation Reduction Act and Bipartisan Infrastructure Law have been the topic of much speculation and more than a little controversy. Now the Biden Administration has issued a set of rules for determining which foreign entities of concern (FEOC) are not eligible for EV-related tax credits and other subsidies. The… Read more »

This provision of the IRA could deliver much bigger results than the EV tax credits

The so-called Inflation Reduction Act includes a long list of measures intended to promote e-mobility and renewable energy. The one that’s gotten the most press is the revamped system of tax credits for EV purchases—and naturally so, because that’s the measure that most drivers can see benefitting them directly. However, as John Voelcker writes in… Read more »

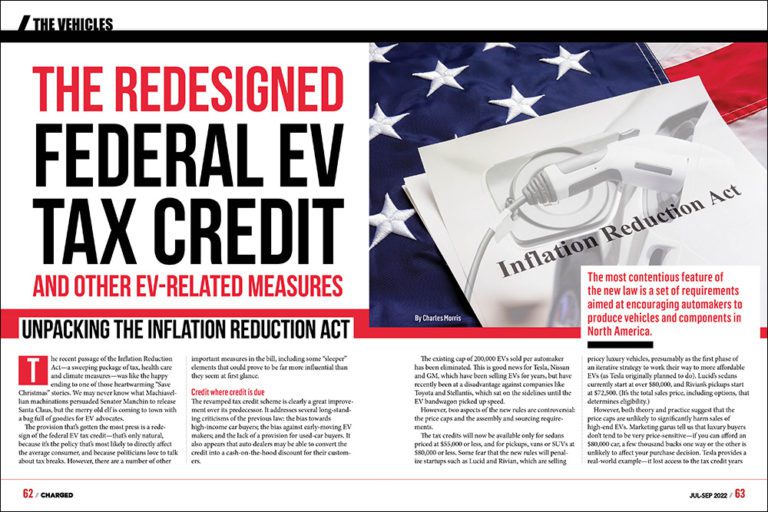

The redesigned federal EV tax credit and other EV-related measures

Unpacking the Inflation Reduction Act The recent passage of the Inflation Reduction Act—a sweeping package of tax, health care and climate measures—was like the happy ending to one of those heartwarming “Save Christmas” stories. We may never know what Machiavellian machinations persuaded Senator Manchin to release Santa Claus, but the merry old elf is coming… Read more »

Plug In America digs deep into the details of the new federal EV tax credit

The revamped federal EV tax credit is the most-discussed part of the Inflation Reduction Act, and there’s plenty to talk about. Like most government programs, it is complex, and like many, it aims to advance more than one goal. The main objective is of course to boost EV adoption from the demand side by making… Read more »

Will the Buy American provisions of the revamped EV tax credit do more harm than good?

Auto industry experts (and others) are beginning to assess the details of the redesigned federal EV tax credit program contained in the Inflation Reduction Act. There’s broad agreement that the changes will help to speed EV adoption, but there’s also concern that some provisions of the law could be counter-productive, at least in the short… Read more »

Parsing the latest proposal to revamp the federal EV tax credit

The House Ways and Means Committee and the Senate Finance Committee have released proposals to revamp the federal EV tax credit program. The two proposals will be reconciled, and the final version is expected to be included in the pending reconciliation package. The Zero Emission Transportation Association has published a detailed description of the two,… Read more »

Clean Energy for America bill, including $12,500 EV tax credit, advances in Senate

A bill called Clean Energy for America advanced in the US Senate Finance Committee on a 14-14 tie vote. The bill, which contains a number of measures designed to incentivize clean energy, clean transportation and energy efficiency, must now be approved by the full Senate and the House of Representatives in order to become law…. Read more »

Proposed legislation would restore federal EV tax credit to GM and Tesla

Democrats in the House of Representatives have reintroduced the GREEN Act (Growing Renewable Energy and Efficiency Now), which among many other tax code revisions would once again allow Tesla and GM customers to claim federal EV tax credits. A similar bill failed to pass in 2020, but the prospects for passage seem bright under the… Read more »

Republican senators introduce new bill to end EV tax credit and impose new annual EV tax

Belying their party’s professed anti-tax leanings, Republican senators have introduced a bill to kill the federal tax credit for EV purchases, and impose a new annual tax on EV owners. Senators John Barrasso (R-Wyoming), Pat Roberts (R-Kansas) and Mike Enzi (R-Wyoming), have introduced a second bill to kill the tax credit (Senator Barrasso introduced a… Read more »