Sometimes public policy gets skewered on the horns of a dilemma. The Buy American provisions of the Inflation Reduction Act are aimed at protecting US jobs (and national security) by making EVs with substantial amounts of battery components from “nations of concern”—namely China—ineligible for tax credits. That’s a worthy goal, but to a certain extent… Read more »

Search Results Found For: "EV tax credit"

IRS releases more details about new tax credits: some foreign-assembled EVs may be eligible

We’re pleased that our pols revamped the federal EV tax credit—the new deal fixed some of the problems with the old rules, and added incentives to encourage the development of a North American supply chain for EVs and batteries. However, as is the case with any new government program, passing the law was just one… Read more »

News flash: EV buyers prefer rebates to tax credits

A new survey has confirmed something that Charged and other EV media have been saying for years: the US federal EV tax credit is about as inefficient a way to encourage EV adoption as could be imagined. Providing a “cash on the hood” rebate instead could have resulted in more EV sales at a lower… Read more »

New front in the war against EVs: ferreting out erroneous tax credit claims

Governments often use selective law enforcement to blunt the effects of unwanted policies instituted by previous administrations. Is this what’s going on with an audit of federal EV tax credit claims? The Wall Street Journal reports that the Treasury Inspector General for Tax Administration (TIGTA), an arm of the Treasury Department and thus of the… Read more »

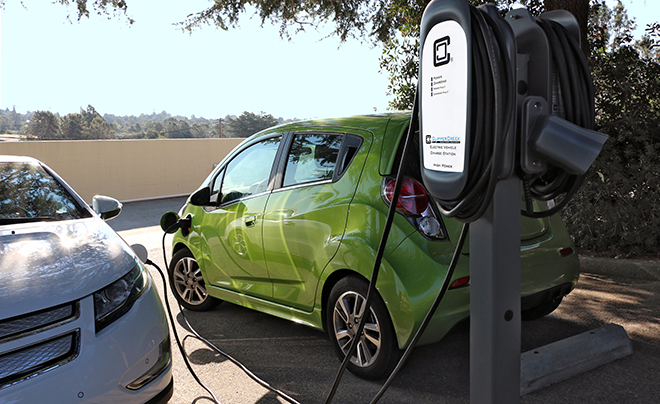

US budget deal reinstates EV charging station tax credit

Green initiatives are on the chopping block in Washington these days, but two of the most important federal incentives have escaped the axe for now. After a bit of back-and-forth, the federal tax credit for plug-in car purchases survived in the final version of the Republicans’ tax cut bill. Now Congress has added a few… Read more »

Georgia reverses policy on EVs, eliminating tax credit and imposing yearly fee

As expected, last week Georgia’s legislature passed a highway funding bill that not only eliminates the state’s $5,000 tax credit for EV purchases (effective July 1), but imposes a yearly user fee – $200 for personal vehicles and $300 for commercial EVs. Other states have introduced, or are considering, fees for EV drivers, but Georgia’s… Read more »

Georgia Senate votes to eliminate tax credit and impose yearly registration fee on EVs

It’s not looking good for Georgia’s EV tax credit. The Georgia Senate has passed a transportation funding bill that would eliminate the state’s $5,000 tax credit for leases and purchases of EVs. In fact, the bill imposes a yearly registration fee on EVs: $200 a year for personal vehicles and $300 a year for commercial… Read more »

Retroactive federal tax credit now available for EV charging stations

If we’re going to drive off a cliff, at least we can do so with our batteries fully charged. As part of the agreement that slammed on the brakes just short of the so-called “fiscal cliff,” the federal government reinstated a tax credit for EV charging stations that had expired at the end of 2011…. Read more »

AMP’s EV conversions are eligible for federal tax credit

Cincinnati-based AMP specializes in converting legacy vehicles to electric power.

President Obama and Democratic Senators support tax credit for EV manufacturers

Senator Sherrod Brown (D-Ohio) has authored a bill called the Security in Energy and Manufacturing Act, which would renew the Advanced Energy Manufacturing Tax Credit.