By Scott Shepard, Senior Research Analyst at Navigant Research’s Transportation Efficiencies program

Smartphones have really changed the way things get done, and the continuous and sometimes overwhelming revolutions enabled by our hand-held devices are only just beginning. The transformations still to come include the basic process by which people and things are moved. The addition of autonomous vehicle technologies to emerging car sharing and ride hailing services is the first step toward a transportation landscape increasingly dependent on shared vehicles. The potential move away from the personally owned vehicle has implications likely to cascade through all industries that support or are touched by the automotive sector.

“Transportation network company” (TNC) is another new term that resulted from the creation of companies such as Uber and Lyft. Put simply, TNCs use smartphones to connect vehicle owners with people in need of a ride, and to handle all the interactions between driver and passenger regarding destination, cost, and transactions. As it turns out, these small efficiencies really matter to the average consumer, and the business model has prospered in its short existence. However, the greatest efficiency savings are yet to be achieved, and they will be made at the expense of the human driver.

An analysis performed by the Rocky Mountain Institute (RMI) on the per-mile costs of existing TNC services versus personally owned vehicles – based on a Toyota Camry ICE vehicle – found that the average TNC cost per mile was just over $2, while personally owned vehicles cost around $0.85. Driver earnings accounted for the vast majority of the TNC cost per mile calculation – when automation costs were added and driver earnings removed, the cost per mile of TNC services dropped to near-parity with the personally owned vehicle, at under $1 per mile. RMI’s conclusion: such cost savings would enable consumers to choose TNC services exclusively over a personal vehicle. If this is correct, it is likely that vehicles enrolled in such services could displace personally owned vehicles and demand for public transit options at alarming rates.

Math

The transportation system is a function of demand, measured in either passenger miles traveled (PMT) or cargo miles traveled. These two measurements are the sum of miles traveled by people or things; for example, a car traveling one mile with two people would represent two PMT. Estimating average vehicle occupancy (number of people or things traveled per mile) and average annual vehicle miles traveled (VMT), allows the calculation of the likely number of vehicles in use as follows; vehicles in use=PMT/(Occupancy×VMT).

Unburdened by driver fatigue, the automated TNC vehicle will undergo significantly more utilization than the personally owned vehicle – likely beyond 60,000 miles annually. If the theorized economics of automated TNC services prove out, then the number of automated TNC vehicles in use is likely to grow. As the above equation portends, increasing the number of highly utilized vehicles would consequently increase average VMT, putting downward pressure on the number of vehicles in use.

Theory

This does not mean there will be fewer vehicles driving – in fact there will probably be more. Automated TNC services are likely to pull demand from public transit options (buses, light rail, etc.) and increase transportation system use among populations with limited capabilities to use the existing system. More vehicles in use means that there are likely to be far fewer vehicles parked, which would have significant benefits for inner-city congestion and landscapes.

Beyond the congestion and space savings that automated TNC vehicles likely enable, it is also probable that they will increase vehicle energy efficiency, but, at least initially, decrease overall transportation system efficiency. Advances in vehicle energy efficiency are driven primarily by the natural desire of TNCs to reduce costs and the likely decline of inefficient stop-and-go driving because of increased vehicle automation. However, the advance in vehicle energy efficiency will likely be lost as passengers are pulled from public transit options. Although public transit vehicles are usually the most energy-inefficient, their service yields the greatest efficiencies due to the large number of passengers they can hold. Therefore, each PMT displaced from that system by even the most energy efficient TNC vehicle will likely result in an energy efficiency loss.

Analysis

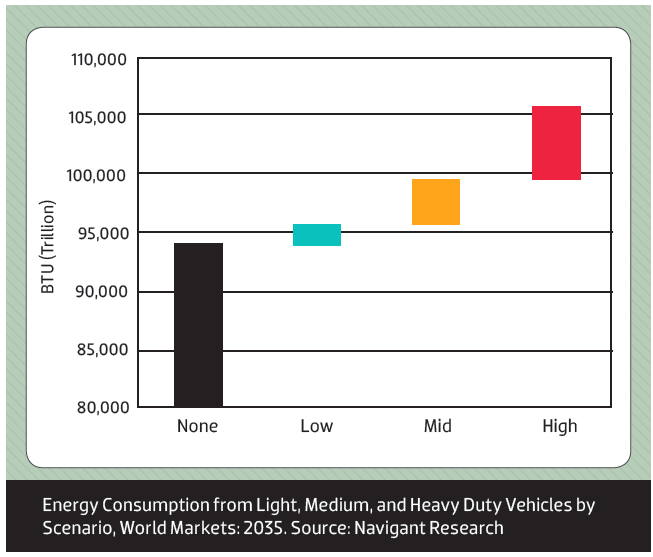

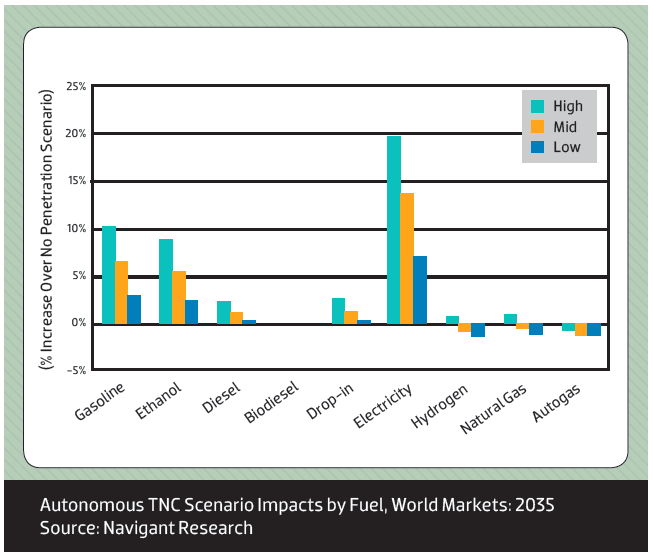

Navigant Research’s upcoming report, Global Fuels Consumption, analyzes the overall effect that automated TNC services are likely to have on transportation system energy consumption by fuel under four autonomous TNC vehicle penetration scenarios, including a scenario in which there is no penetration. Scenario penetrations vary across the globe, with the highest found in regions with dense populations. The low scenario places automated TNC vehicle penetrations within the vehicle fleet between 4%-10% by 2035, the high scenario does so between 13%-41%. Under no penetration, energy consumption rises from near 80 quadrillion BTU in 2016 to over 94 quadrillion BTU by 2035. In the highest TNC penetration scenario, total energy consumption increases by nearly 7% in 2035.

The real question underlying this is, what fuel will provide the energy? The answer to this question is a function of the vehicle powertrain that is preferred by the future TNC. Vehicle durability, refueling capability, range, and government policy (more local than national) will play pivotal roles in determining TNC preferences, but it is too early to determine which powertrain will offer the best option. Beyond these considerations, the most important vehicle aspect will be its size. In that regard, if average light vehicle occupancy remains unchanged (as Navigant Research assumes it will), TNCs are likely to prefer smaller vehicles. All other considerations held equal, vehicle powertrains with competitive cost advantages in small car segments should benefit the most. Also, vehicle powertrains competitive in bus segments should be negatively affected.

The final results of the analysis are mixed regionally, due to the varying distribution of the existing vehicle fleet and likely market preferences and vehicle availability by powertrain. Generally, however, electricity consumption benefits are greatest due to the competitive advantages of battery-electric powertrains in small car segments. Similarly, fuel-efficient stop-start vehicles and hybrids – also highly competitive in small car segments – buoy gasoline and ethanol consumption. Other fuels with competitive advantages in bus or light truck segments fare less well, though the high penetration scenario does have a slight benefit to almost all fuels due to the dramatic pull from highly energy-efficient public transit options.

The pairing of highly efficient powertrains in autonomous TNC vehicles can mitigate efficiency losses witnessed on behalf of moves from public transit options. Potential cost declines for batteries are likely to realize significant cost advantages to battery-electric vehicles over competing powertrains, which may naturally make them better options for TNCs. It is not yet clear, however, if these vehicles can achieve capability advantages that would make them ideal for TNC services before 2035 at such competitive costs. Needed capability achievements are focused on the speed and process of charging as well as the durability and capacity of batteries.

This article originally appeared in Charged Issue 29 – January/February 2017 – Subscribe now.