The unusual journey of AMP Electric Vehicles has positioned it to become a leading OEM producing alternative-fuel vehicles for the medium-duty market.

Seven years ago, AMP Electric Vehicles was founded on the idea of converting passenger vehicles – originally designed with an internal combustion engine, gas tank, and related components – to electric drive. The company’s goal was to design an electric powertrain around a popular vehicle model, then convince the OEM that was already mass-producing that vehicle to sell it to AMP as a “glider” – a version without a drivetrain.

Over the years, however, two problems became apparent. First, the major automakers were hesitant to cooperate. Second, the passenger EV market didn’t materialize quite as fast as AMP, and other manufacturers, had hoped it would.

As a small company, AMP had to shift to a different business model that promised more near-term revenue. From AMP’s point of view, the passenger EV market was being held back by a lack of public charging infrastructure and the high price premium on the vehicles.

“We looked for places where those two factors wouldn’t be a problem, and we landed on fleets,” AMP CEO Steve Burns told Charged. “Specialty fleets have predictable routes, and return back to the barn every night to be charged. They never have to worry about finding a charging station, so that solves the infrastructure problem.”

AMP then looked for fleet vehicles with the worst gas mileage, because the worse the gas mileage was, the quicker the payback for the electric premium. “What popped up was large step van delivery trucks. They’re heavy, and they’re not aerodynamic. In fact, they cut through the wind like a brick, and only get about get about 6 or 7 mpg,” said Burns. AMP thought that fleet EVs would make economic sense, and the revolution could really start with plug-in work vehicles that are cheaper to own and operate over their life cycles. “About a year ago we announced that we were getting out of passenger vehicles to concentrate on building a drivetrain for trucks.”

AMP’s initial plan for trucks was similar to its plan for passenger vehicles – repower some of the 300,000 step vans already built and deployed in the US.

However, in a rare stroke of luck for AMP, the commercial vehicle powerhouse Navistar decided to sell off its Workhorse subsidiary, a step van chassis manufacturer, including the Workhorse factory in Indiana.

Conventional wisdom is that if you’re going to build a car company from scratch, you need a billion dollars. Tesla and Fisker recently reinforced that theory (actually, it cost each of them more than a billion, but they were making electric cars from scratch). The same wisdom holds that if you’re going to build trucks – and you want to put them on American roads, with all the ensuing regulatory, durability, and engineering requirements – that’s about four or five hundred million. The details of the Workhorse acquisition are not public, but Burns told us that because of the position Navistar was in, AMP “was able to get a pretty inexpensive ticket to that dance. There are not a lot of other OEMs out there, so we’re pretty excited about it.”

In fact, in the step van industry, Freightliner and Ford are the only other major manufacturers in the US. Burns noted that Navistar/Workhorse and Freightliner have traditionally split the lion’s share of the market, each averaging about 4,000 vehicles per year for the last few years.

The newly acquired factory makes gas versions, and AMP will add electric, propane, and natural gas to the lineup. “Being an OEM is a volume game,” Burns explains. “If we’re making a lot of the chassis, it keeps the cost down, so we’re going to continue to make gas versions. It’s a lot easier than waiting for the EV revolution to take off and then starting to build them from scratch. We’re the only truck company we know of in the medium-duty space that’s building four different versions of powertrains.”

AMP will restart the Workhorse factory in the first quarter of next year, and presumably build a lot more gas trucks in the beginning, as the market for electric vehicles expands.

Follow the money

Just days before our interview with Burns, New York State announced a $19 million voucher incentive program to subsidize the purchase of electric, hybrid and alternative-fuel commercial trucks.

AMP and three other electric truck makers (Boulder Electric Vehicle, Electric Vehicles International and Smith Electric Vehicles) were listed as approved vendors.

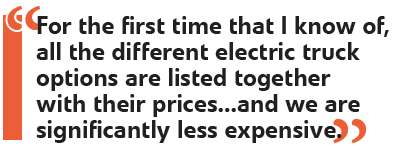

AMP had a hunch that building its own chassis, instead of buying them from a supplier, would give it a price-point advantage over the competition. Based on the documents released by New York State, it was right.

On the New York Truck Voucher website, AMP’s step van is listed at more than $30,000 below offerings with similar battery pack capacity from other manufacturers. AMP’s Walk In Van with 100 kWh pack is $133,000, compared to $166,442 for Smith Electric Vehicles’ 100 kWh Newton and $185,000 for EVI’s Walk In Van with 99 kWh (although both the Smith and EVI trucks have a higher maximum GVWR, at 26,000 lbs. vs. 19,500 lbs. for AMP’s truck).

“It’s tougher to make money when you’re buying the chassis from someone else to start with,” said Burns, “so we’re very competitive on price.”

All three trucks will qualify for the maximum $60,000 voucher. Considering the fuel savings, that should make all of these trucks a no-brainer purchase for fleet managers in New York. It’s easy math when vouchers bring EVs down to the same prices as diesel trucks.

In fact, even without a voucher, the savings for long-route electric delivery trucks add up to big numbers over a vehicle’s lifespan, as Charged has explored in great detail in previous articles.

AMP knows that it can’t build a business based on government incentives, because eventually they’ll go away. “We’ll have a battery leasing program, and it will put you into an electric truck for the same price as a diesel,” explained Burns. “Then leasing the batteries is less than the monthly diesel bill. Diesel is usually the biggest expense for these types of companies. Historically, electricity costs are extremely stable compared to diesel. What is the price of diesel going to be in ten years? Nobody knows. You would expect that it’s going to be higher than it is today, perhaps significantly higher. When diesel is your number-one expense, and it’s all over the board, it’s very hard to plan your business.”

Although electric truck sales will largely follow the vouchers for as long as they’re out there – as they do in California, New York and soon in Chicago – Burns believes that a wise fleet manager will look at the numbers and see big potential. Even with no voucher and a high initial price, an electric truck could realize a payback in as little as three years. “If you keep the trucks for 20 years, that’s 17 years of gravy,” said Burns.

Driving out costs

AMP is focused on building low-cost drivetrain systems with high reliability, so its philosophy is to use proven mass-produced components whenever possible. For electric trucks, AMP’s engineers chose to use hybrid motors built by Remy. Hundreds of thousands of them are already on the road, they’re well proven, automotive grade, and all of their development costs have been fully amortized.

“If we would buy a motor designed specifically for electric trucks, those would be much more expensive,” said Burns. “We’re using the same motor that Remy supplies to GM and Mercedes for hybrids, but we use two of them in each truck.”

AMP buys a variety of different kinds of cells, and Burns reports that the format it’s been having the most success with is also used by electric bike builders in China. The cells are mass-produced in a fully automated process, so the quality is consistent and the price is fair. Because AMP does the packaging, including electronics and heating and cooling, it can switch cell vendors if a battery maker has quality trouble or goes out of business. That also allows AMP to continually look for the best deal on the market. Burns says, “in this business someone always has a carrot out there saying ‘we’ve got a better battery for less money.’” As new technology emerges into commercial availability, AMP is poised to take advantage of it.

In the New York voucher program, AMP is offering its step van with a 100 kWh pack. At present, the company doesn’t plan to build any trucks with “small” packs. For one thing, longer routes have shorter payback periods for EVs, so long-range trucks are more financially attractive. Also, AMP has found that the longevity of a battery pack increases with its capacity. “With a small pack, high charge and discharge rates make more of a problem – like fast charging, heavy regeneration or quick accelerations. With a larger pack, the relative ins and outs aren’t as dramatic. It turns out that the larger the pack, the less capacity fade will occur. If you’re bringing a smaller pack to its knees every day, it’s not going to last very long. We’re making trucks that will last for more than ten years, so they’re all relatively big batteries.”

Neither snow nor rain nor heat…

AMP is confident that it has designed a robust electric drivetrain. In April, the company announced the completion of third-party reliability testing. Accelerated durability testing by the Transportation Research Center took place in Ohio, and ran for 4,000 miles in the middle of winter.

The comprehensive workout included “traversing a series of resonance, chatter, and impact bumps…moderate washboards, frame twists, dips, inverted chuckholes, stopping and starting on a 20% brake slope, ‘lock-to-lock’ figure-8 maneuvers, a short slalom course and traversing gravel roads.”

Burns proudly reports passing with flying colors. “Nothing went wrong, which is really quite phenomenal for a smaller company.”

With a drivetrain developed and optimized in gas-to-electric conversions, and now a truck-building factory, AMP is on a path reminiscent of another phenomenal EV story, Tesla Motors. Before cranking out the Model S in its Fremont, California plant, Tesla was essentially a conversion company working closely with Lotus to build Roadsters. Burns is happy to be compared to the EV standard-bearer, and hopes to continue down the path Tesla is blazing towards substantial price breakthroughs for plug-in vehicles of all shapes and sizes.

This article originally appeared in Charged Issue 10 – OCT 2013